Making money on the Forex market is easy! Can't believe it?

Try this Renko indicator!

Works on any asset

This Renko trading Strategy is able to work on any asset – currency pairs and cryptocurrencies, company shares and stock indexes. Choose any one and start making a real profit!

Signals every day

Renko Chart indicator gives more than 10 signals per day on each asset. Trade on several assets at once and get a lot of signals every day!

High profitability

The high accuracy of the signals of this renko strategy will help you to increase the size of your capital very quickly! 100% growth per month is quite real!

Clear signals system

When to open trades and when to close trades – the signals of this renko strategy will tell you about it. Just follow them and make a profit!

Low trading drawdown

This intraday renko system provides high accuracy of deals, each deal is protected by a Stop Loss order. All this allows you to trade with a minimum drawdown. That is, to quickly increase your capital and protect yourself from its loss.

Utility as a gift

Each buyer receives a utility as a gift that will help you manage your transactions – close them on time with maximum profit or cut losses.

How does it work?

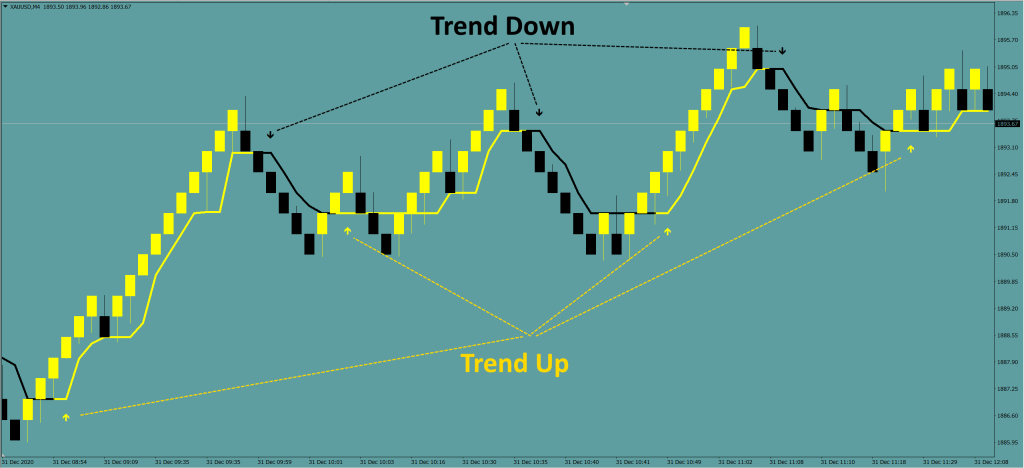

First, a special renko indicator transforms a regular quote chart into a RENKO chart.

It is much better to analyze the market movement on such a chart. all candlesticks have the same size and each wave of growth or decline has clear shapes.

Determining the direction of the trend

The Renko Chart indicator helps you to see when the wave of growth begins and when the wave of decline begins. The dynamics of the market becomes clear to you!

Next, we determine the price channel

A special Renko Chart indicator determines the boundaries of the price channel, that is, the levels at which quotes most often turn in the opposite direction. such boundaries make us understand where to open and close trades, where to set Stop Loss and Take Profit levels.

How to trade? It's easy!

You get a signal that the trend has changed and the quotes have turned in the opposite direction. We look at the Renko Chart channel to assess the further potential of the movement. We conclude a deal and fix a profit when the quotes reach the center or the opposite border of the price channel.

What is the result?

These are the results of trading with Renko trading Strategy system for 2 week:

Why exactly Renko trading Strategy?

- Works on any asset

- Gives 10-70% profit per month

- Provides Alerts, Pop-up and Push notifications for trading

- Receive many trading signals every day

What is a Renko Chart?

A Renko Chart is a type of financial chart that traders use to track the price movement of assets. Unlike traditional charts such as candlestick or bar charts, which are based on time intervals, Renko Charts are solely based on price changes. The term "Renko" is derived from the Japanese word "renga," meaning brick, which aptly describes the chart's appearance—bricks or blocks that represent a specified price movement. Each brick on a Renko Chart is added once the price moves a predetermined amount, regardless of the time it takes to achieve this movement.

Why Are Renko Charts More Convenient for Trading?

Renko Charts are praised for their ability to filter out market noise, providing a clearer picture of the underlying trend. This makes them particularly advantageous for traders, especially those focusing on intraday Renko trading. Here are some reasons why Renko Charts are considered more convenient:

- Noise Reduction: By ignoring minor price fluctuations that do not meet the specified threshold, Renko Charts help traders focus on significant trends and price movements.

- Trend Identification: Renko Charts make it easier to identify and follow trends, as they emphasize direction over time. This clarity can aid traders in making more informed decisions.

- Simplified Analysis: The clean and straightforward nature of Renko Charts allows traders to quickly interpret market conditions, making it easier to implement and follow a Renko trading strategy.

What is a Renko Trading Strategy?

A Renko trading strategy involves using Renko Charts to make trading decisions. The primary goal is to capitalize on clear trend signals and price movements while avoiding market noise. Here are some common elements of a Renko trading strategy:

- Brick Size Determination: Choosing an appropriate brick size is crucial. A smaller brick size might capture more detailed price movements but could introduce more noise, while a larger brick size will emphasize broader trends.

- Trend Following: Many Renko trading strategies focus on identifying and following trends. Traders often enter trades when a new brick confirms the continuation of a trend and exit when a reversal is indicated.

- Combining Indicators: To enhance the effectiveness of a Renko trading strategy, traders often use additional indicators such as moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence).

Platforms for Renko Trading: MT4 and MT5

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are popular trading platforms that support Renko trading. Both platforms offer robust functionalities for implementing and customizing Renko Charts.

MT4: Known for its user-friendly interface and extensive range of available indicators, MT4 allows traders to use custom Renko indicators. The platform supports intraday Renko trading, enabling traders to refine their strategies with precision.

MT5: As the successor to MT4, MT5 offers enhanced features, including more timeframes, advanced charting tools, and superior execution capabilities. MT5's flexibility makes it an excellent choice for those looking to employ Renko Charts in their trading arsenal.

Conclusion

Renko Charts provide a unique and effective way to analyze market trends by focusing on price movements rather than time intervals. Their ability to filter out noise and highlight significant trends makes them an invaluable tool for traders. By adopting a well-defined Renko trading strategy and leveraging platforms like MT4 and MT5, traders can potentially improve their trading performance and achieve better results in intraday Renko trading. Whether you're a novice or an experienced trader, incorporating Renko Charts into your trading approach could offer a clearer, more precise view of the market's direction.