+1,183.37% confirmed growth on a real account

Prop Firm Algo

We introduce to you an elite Algo trading solution designed for automated trading. Whether you're engaging in Proprietary Trading Firms or private trading, the decision is in your hands! This Prop Firm EA is engineered for consistent profitability with minimal trading drawdowns, embodying every trader's ultimate aspiration!

- Minimum capital to start: 200$

- leverage 1:30 is enough

- Maximum drawdown up to 5%

- 10 assets to trade

- Three trading strategies in one bot: Reverse, Trend and Grid.

- Timeframe for trading - H1

- Without averaging and without martingale

- Each deal is protected by Stop Loss

- Maximum 1 trade at a time

This Prop Firm Expert Advisor created for:

- Prop Firm Trading

- Private Trading

- Professional Capital Management

Let's evaluate its advantages in order:

This is an Prop Firm Algo Project profitability monitoring, conducted through an independent third-party service, showcasing the impressive profitability of this software in action. Take note of the minimal trading drawdown and remarkable growth percentages:

The Prop Firm EA offers the versatility of trading using three distinct strategies: trend strategy, reversal strategy, and grid strategy. Simply put, purchasing one robot grants you access to three strategies in one package! An excellent acquisition, friends!

REVERSE

- Maximum 1 trade at a time

- 10 assets to trade

- Day trading strategy - "Reverse"

- Without averaging and without martingale

- Each deal is protected by Stop Loss

- Timeframe for trading - H1

TREND

- Maximum 2 trade at a time

- 7 assets to trade

- Day trading strategy - "Trend"

- Without averaging and without martingale

- Each deal is protected by Stop Loss

- Timeframe for trading - H1

GRID

- Maximum 8 trade at a time

- 5 assets to trade

- Day trading strategy - "Grid"

- Averaging without martingale

- Without Stop Loss

- Timeframe for trading - H1

- Minimum trading drawdown

- No averaging and no martingale

- 1:30 leverage is enough

- All deals are protected by Stop Loss

The best EA for prop firm Algo Project software avoids risky money management techniques. Every deal is safeguarded with a Stop Loss to ensure protection against significant losses. Check out the video below to witness the seamless execution of the Algo trading strategy in action:

REVERSE STRATEGY

- Maximum 1 trade at a time

- 10 assets to trade

- Day trading strategy - "Reverse"

- Without averaging and without martingale

- Each deal is protected by Stop Loss

- Timeframe for trading - H1

TREND STRATEGY

- Maximum 2 trade at a time

- 7 assets to trade

- Day trading strategy - "Trend"

- Without averaging and without martingale

- Each deal is protected by Stop Loss

- Timeframe for trading - H1

In addition, each buyer receives a gift - Algo Project grid strategy. This strategy will be useful for those who have a leverage of more than 1:100

GRID STRATEGY

- Maximum 8 trade at a time

- 5 assets to trade

- Day trading strategy - "Grid"

- Averaging without martingale

- Without Stop Loss

- Timeframe for trading - H1

You buy ONE "Algo Project" product and immediately get TWO Prop Firm EA that will work on versions 4 and 5 of the world's most popular platform!

1 bot for 2 platforms

Our trading software is suitable for most popular Prop Firms

Haven't secured a victory in any challenge yet? Our Prop Firm Expert Advisor is your key to achieving winning positions in any competition! You can have peace of mind knowing that success is within reach!

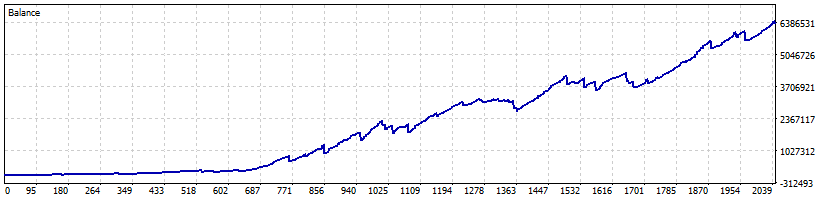

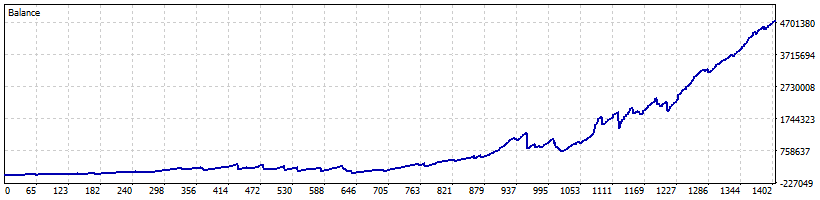

How does this Algo Prop Firms EA work in the automatic strategy tester?

When evaluating the "Algo Project" Prop Firm expert advisor in a strategy tester, the process involves rigorously testing its performance under various market conditions. By deliberately applying extremely risky settings, we challenge the software's resilience and adaptability. This approach aims to simulate high-volatility market scenarios to assess how the software manages risk, executes trades, and maintains profitability despite the intensified risk parameters. This kind of testing is crucial for understanding the limits and capabilities of the Prop Firm Algo Project bot within a Prop Firm's trading framework.

With its settings dialed to maximum performance, our proprietary EA has the potential to escalate an account to up to 2 million dollars in merely a few years, focusing solely on one currency pair. Given the capability to simultaneously trade 10 different assets, this performance can be exponentially increased tenfold! Just picture the rapid growth your account could experience!

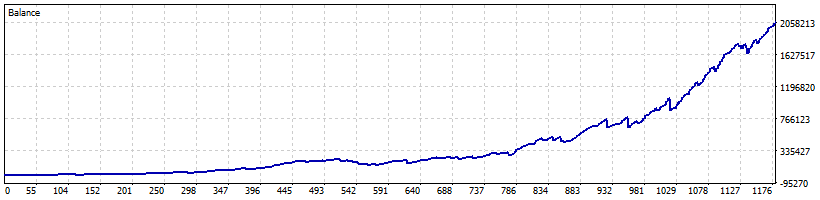

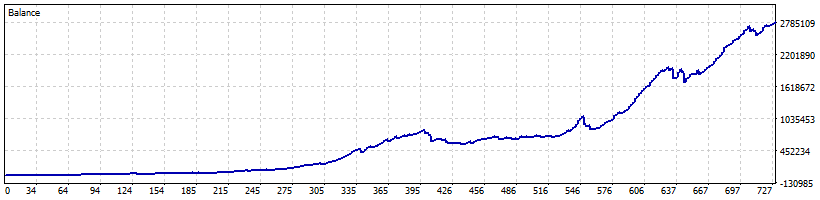

Algo Prop Firms bot test results:

EURUSD

EURUSD prop firm EA trading

Total Net Profit: $6 357 902.90

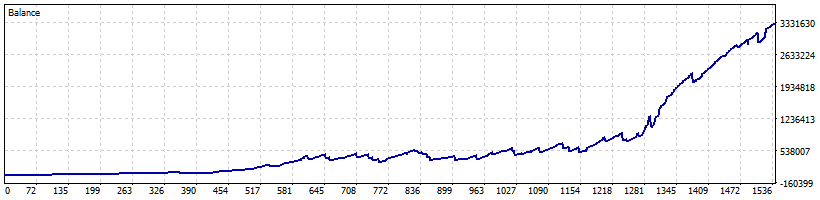

EURGBP

EURGBP prop firm algo trading

Total Net Profit: $4 694 758.36

AUDCAD

AUDCAD prop firm EA trading

Total Net Profit: $2,069,864.97

EURAUD

EURAUD prop firm algo trading

Total Net Profit: $3 356 739.76

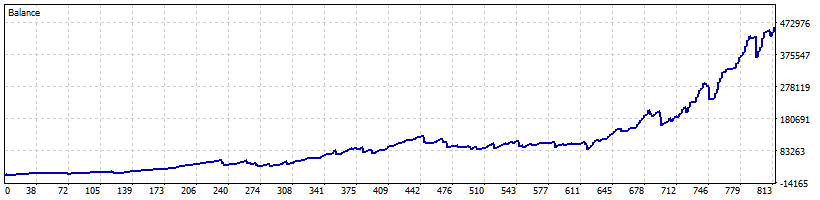

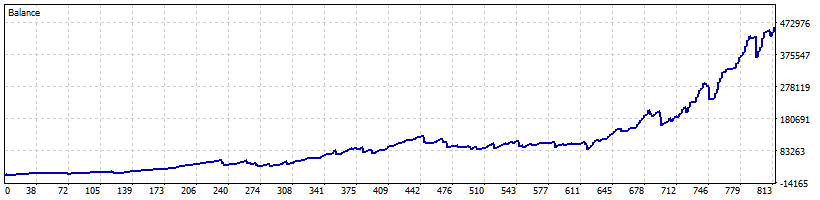

AUDUSD

AUDUSD prop firm EA trading

Total Net Profit: $467 873.39

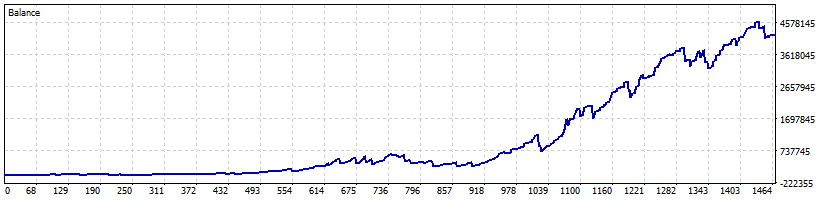

GBPUSD

GBPUSD prop firm algo trading

Total Net Profit: $4 212 417.46

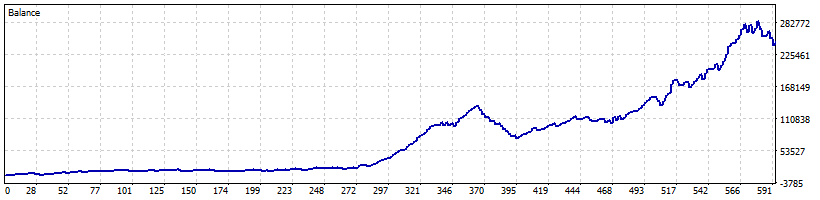

NZDUSD

NZDUSD prop firm EA trading

Total Net Profit: $2 804 428.39

GBPCAD

GBPCAD prop firm algo trading

Total Net Profit: $75 280.63

USDCAD

USDCAD prop firm EA trading

Total Net Profit: $239 330.97

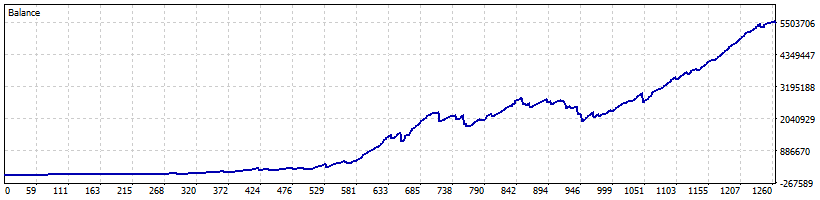

USDJPY

USDJPY prop firm algo trading

Total Net Profit: $5 486 540.82

Our Prop trading bot Algo Project harnesses the power of unique "Reversal" and "Trend" trading strategies, which we meticulously optimize every six months to maintain cutting-edge performance. To ensure that each client achieves optimal results, we provide them with unique settings for precise customization, laying the groundwork for continued exceptional performance.

The foundational principles of these trading strategies are detailed below:

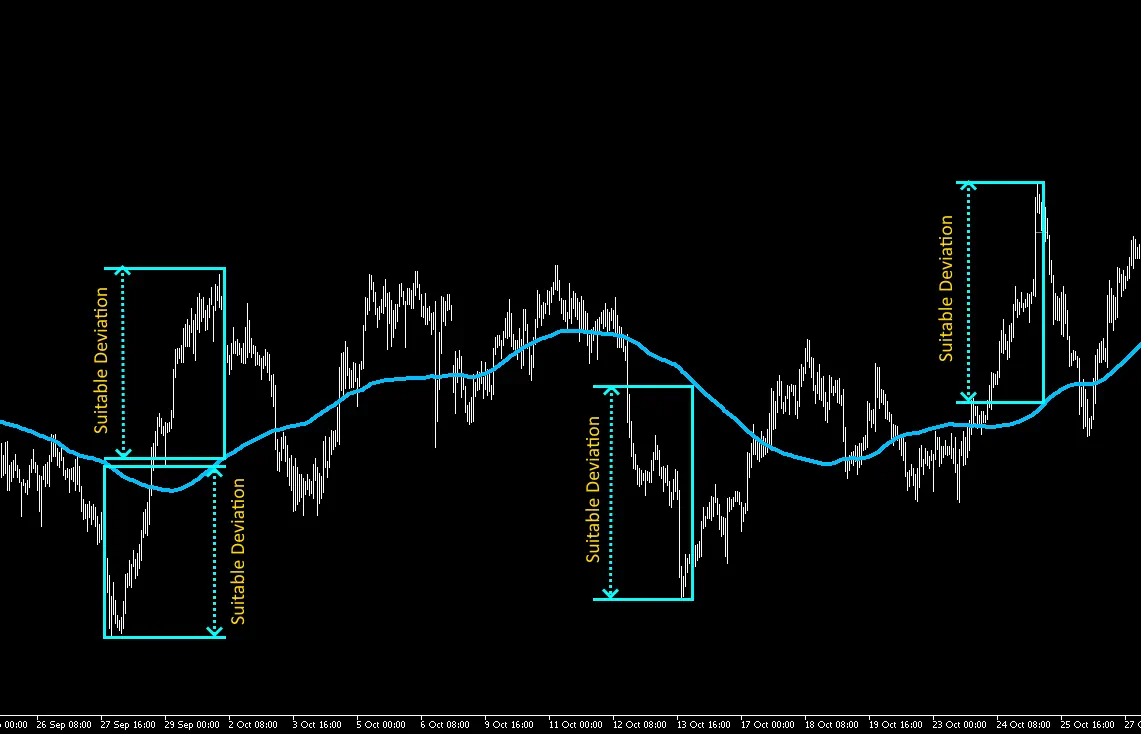

The bot constantly scans the market and finds average statistical deviations

Our Prop Firm expert advisor employs an advanced algorithm designed to continuously monitor the market, pinpointing instances of maximum deviation in quotes from its predetermined cutoff value. It meticulously filters out excess market noise, utilizing these identified patterns to further recognize potential reversal moments. This sophisticated approach allows for the strategic identification of optimal entry points, capitalizing on the moments when the market is most likely to shift direction, thereby maximizing trading efficiency and profitability.

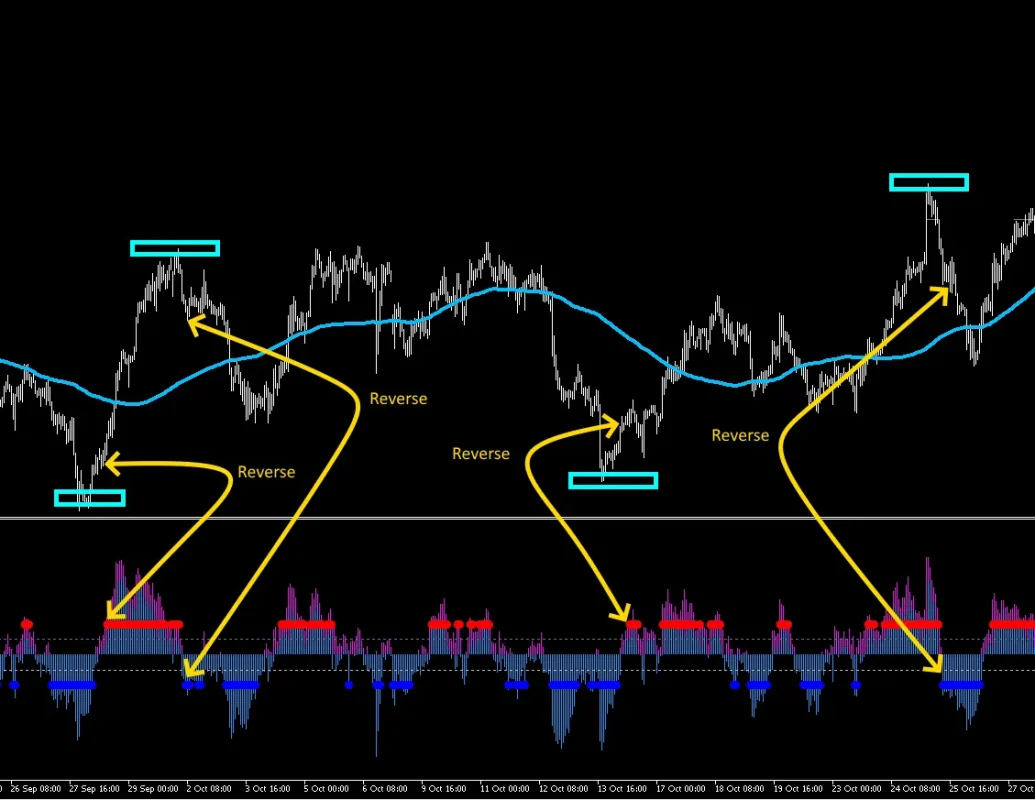

Using a Professional Swing Tool to Find Reversals

Utilizing a specialized Reverse indicator, the best ea for prop firm is adept at identifying the onset of a reversal movement towards the average price value. This timing is considered ideal for initiating trades. In 95% of instances, it's observed that quotes revert to their original moving average level, presenting a prime opportunity for traders to capitalize on these predictable market movements. This strategic approach leverages the inherent market tendency to adjust back to mean values, thereby providing a significant edge in trading decisions.

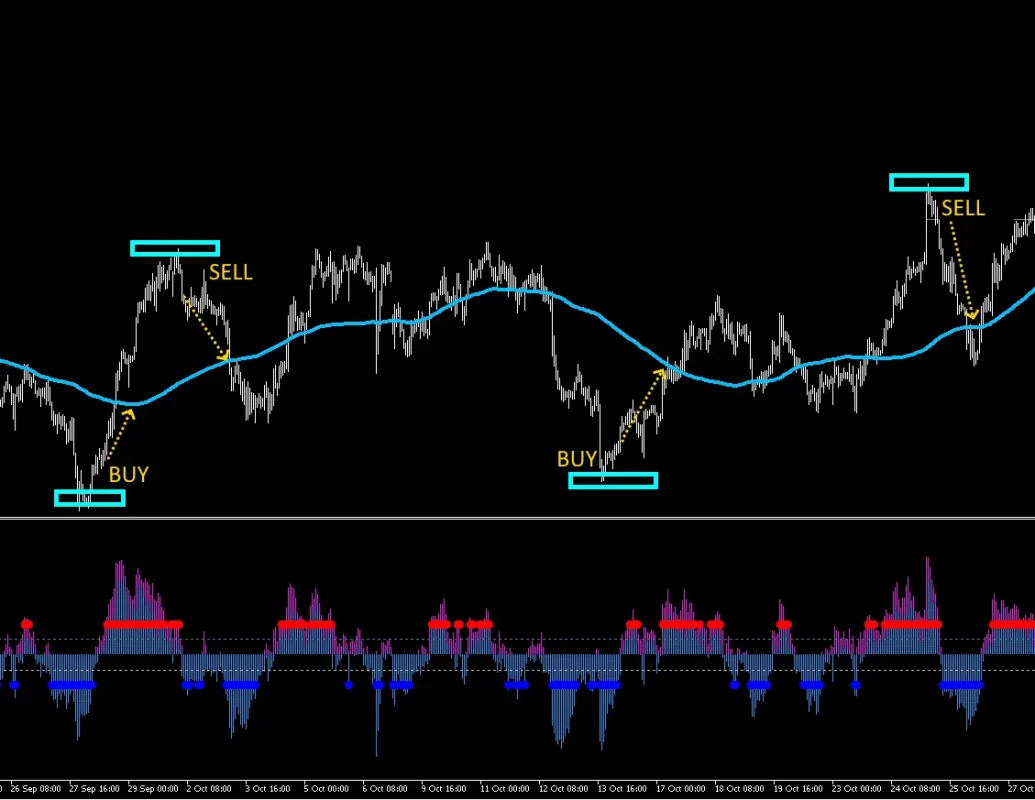

The software makes the deal and intelligently accompanies

Upon identifying a reversal moment, the Prop Firm Trader executes a trade targeting the level of the moving average. As previously mentioned, such reversals result in profits in 95% of cases. The Prop Firm Expert Advisor is equipped with a specialized intelligent system to support open trading operations. This system ensures risk management by implementing Stop Loss on each trade, providing a safety net against potential losses. Additionally, it incorporates an algorithm designed to close trading operations during rollbacks, safeguarding investments if market conditions unexpectedly turn unfavorable. This combination of strategic entry and robust risk management underscores the sophistication and reliability of the Prop Firm Algo Trader.

Our automated Prop Firms trading software operates entirely on autopilot, eliminating the need for manual intervention. Simply set it up, and you can sit back and enjoy the benefits of progressive prop trading. This system is designed to handle all aspects of trading on your behalf, from market analysis to executing trades, ensuring a hassle-free trading experience while you focus on other priorities.

What does the buyer get?

- Algo Project software installation file for MT5

- Algo Project software installation file for MT4

- Extended license for an unlimited number of accounts

- Set files for Prop Firms Trading - for trading no more than 5% max DD

- Set files for Private trading - for trading no more than 15% max DD

- Step-by-step video instructions on how to install and configure

- Remote installation assistance (upon additional request in our support)

- Update every 6 months

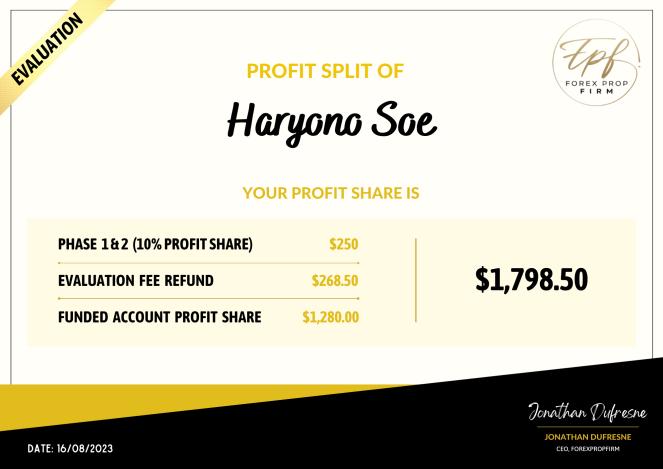

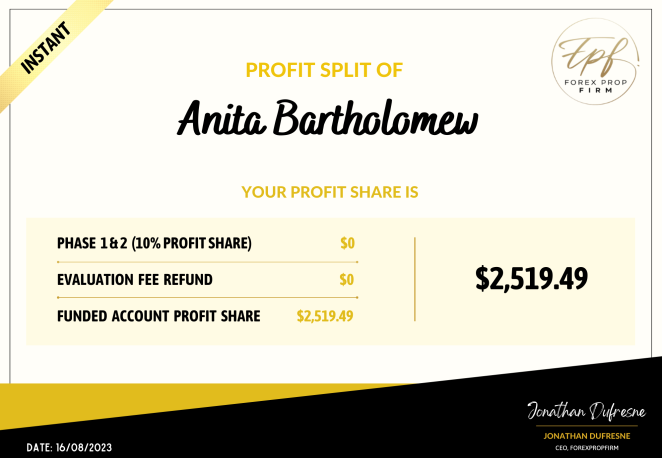

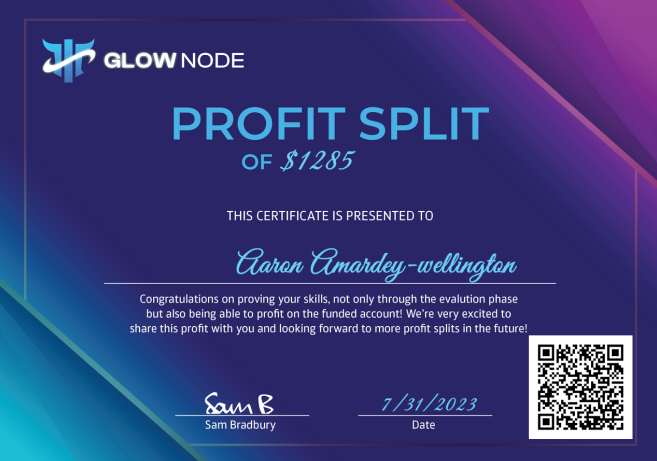

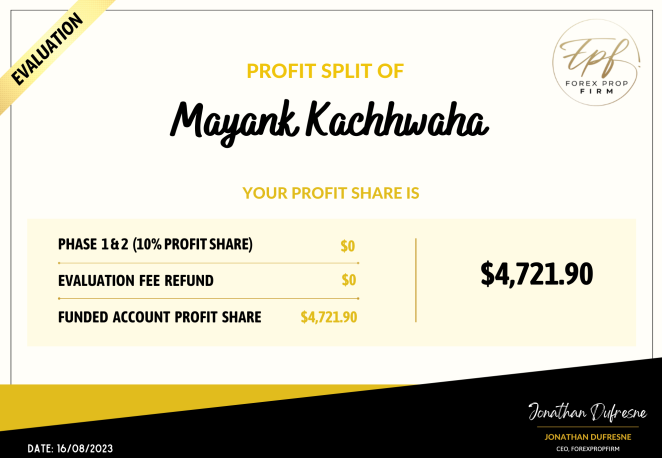

What do other users say? We have collected several Prop Firm Algo trading Reviews from our customers so that you can better understand the opinions of other traders:

The Algo Project has been a game-changer for my trading portfolio. Its ability to consistently identify profitable trades using its advanced algorithms has significantly increased my success rate. Highly recommended for those looking to enhance their trading strategies."

As someone new to trading, I was looking for a tool that could simplify the process while being effective. The Algo Project delivered on both fronts. Its autopilot feature is incredibly user-friendly, and I've seen a steady growth in my investments since I started.

In the competitive world of prop trading, having an edge is crucial. The Algo Project has provided that edge for me, with its sophisticated strategies like Swing Reversal and Trend Following. Its performance and reliability have made it an invaluable part of my trading toolkit.

I was skeptical about using automated trading software, but the Algo Project has completely changed my perspective. It's easy to set up, and the results have been beyond my expectations. It's great to see my portfolio growing without having to spend hours analyzing the markets.

The precision and efficiency of the Algo Project are impressive. Its ability to filter out market noise and identify key trading signals aligns perfectly with my analytical approach to trading. The regular updates and optimizations ensure it stays ahead of market changes.

Here we have collected some detailed information regarding the Prop Firm Algo trading robot

Algorithmic trading, or algo trading, is a sophisticated method that employs automated, pre-programmed instructions to execute trades based on specific variables such as time, price, and volume. It leverages the superior speed and computational power of computers to help traders secure the best possible prices, reduce slippage and transaction costs, and enhance risk management.

At the heart of algo trading are complex algorithms designed to swiftly analyze market data, spot trading opportunities, and carry out trades autonomously. These strategies can range from straightforward rule-based triggers, like moving average crossovers, to advanced predictive analyses utilizing extensive datasets.

A major benefit of algo trading is its capability to digest and assess vast amounts of data in real-time, surpassing human trader capabilities. This enables the detection of market patterns, trends, and irregularities, potentially leading to more informed and timely decisions. Furthermore, algo trading reduces the impact of emotional decision-making, often linked to poorer trading results.

Institutional investors such as pension funds, mutual funds, and hedge funds primarily use algo trading to manage large orders effectively. Yet, the broadening of trading platforms and market democratization has also brought algo trading within reach of retail traders.

The algo trading landscape is in constant flux, propelled by technological advances, machine learning, and artificial intelligence. These innovations promise to refine trading algorithms further, enhancing their adaptability and learning capacity in response to market shifts. However, algo trading carries its own set of risks, including the possibility of algorithmic errors and the potential to exacerbate market volatility through high-frequency trading strategies.

In summary, algo trading marks a pivotal transformation in financial market operations, presenting both new opportunities and challenges. As market dynamics evolve, the influence of algorithmic trading is set to grow, potentially altering the trading environment in significant ways.

Proprietary trading, or prop trading, involves financial firms or specialized desks trading stocks, bonds, currencies, commodities, derivatives, and other instruments with the firm's own capital, as opposed to client funds. This approach aims at garnering profits directly from market activities for the firm's benefit.

The core of prop trading is exploiting market inefficiencies through advanced trading strategies and capitalizing on short-term price movements. Prop traders, who are often highly skilled in quantitative, fundamental, and technical analysis, use a myriad of strategies. These can range from high-frequency trading, holding positions for mere seconds, to strategies based on in-depth market research over longer periods.

A distinctive feature of prop trading is the autonomy and flexibility it offers traders. Free from the constraints typical of asset management or brokerage roles, prop traders can pursue aggressive strategies and accept higher risks in search of substantial returns. Such risk-taking is counterbalanced by strict risk management measures and continuous monitoring to minimize potential losses.

Moreover, prop trading enhances market liquidity by enabling the buying and selling of large security volumes, thereby facilitating smoother transactions for other participants. However, the practice carries significant risks, potentially impacting the financial stability of the parent firm based on the trading desk's performance.

Following the 2008 financial crisis, prop trading faced increased regulatory scrutiny, especially with the Volcker Rule in the U.S., limiting banks' speculative trading activities. Despite regulatory challenges, prop trading remains an integral part of the financial landscape, fostering innovation in trading strategies and financial products. The rise of technology and algorithmic trading has revolutionized prop trading, allowing for the execution of complex strategies with unprecedented speed and accuracy.

In essence, prop trading is a high-risk, high-reward sector of the financial industry, reliant on market foresight, effective risk management, and efficient trade execution. As financial markets advance, prop trading desks continuously seek innovative strategies and opportunities to preserve their competitive advantage.

Creating a trading robot, also known as an algorithmic trading bot or automated trading system, is a sophisticated process that melds financial market knowledge with high-level IT expertise. The goal is to automate trading strategies for executing orders in financial markets with minimal human oversight. This endeavor involves several critical steps, integrating the acumen of experienced traders with the precision of software engineering.

Strategy Identification: The journey begins with pinpointing an effective trading strategy. This could be based on technical analysis, fundamental analysis, or quantitative techniques, seeking patterns, trends, or anomalies in historical data that could be profitably applied to future market scenarios. The chosen strategy must be clear, rule-based, and quantifiable to facilitate accurate coding.

Backtesting: The identified strategy undergoes extensive backtesting with historical market data to evaluate its viability and potential returns without real-world financial risk. This involves simulating the strategy under various market conditions to analyze performance metrics such as ROI, drawdown, win rate, and risk-reward ratio, often requiring advanced statistical tools and software.

Algorithm Development: With a validated strategy, the next phase involves coding the trading rules into a computer algorithm, necessitating strong programming skills in languages like Python, C++, or Java. The algorithm must faithfully represent the trading strategy, encapsulating trade triggers, position sizing, risk management, and other pertinent rules.

Integration with Trading Platforms: The algorithm is then integrated with trading platforms via APIs, enabling it to access real-time market data, place orders, and manage trades. This step demands ensuring seamless communication with the platform, error handling, and adherence to platform-specific limitations on data usage and transaction rates.

Simulation and Forward Testing: Prior to real-world deployment, the robot is subjected to simulation or paper trading to test its effectiveness in a live-market environment using real-time data but without actual financial transactions. This stage aids in refining the algorithm, resolving execution issues, and optimizing performance parameters.

Deployment and Monitoring: After exhaustive testing, the robot is launched in the live market. Continuous monitoring is crucial to confirm its performance meets expectations and to adjust for market dynamics. Attention to system stability, connectivity, and unexpected market events is also vital to maintain operational integrity.

Ongoing Optimization: Given the ever-changing nature of financial markets, regular review and optimization of the trading robot are necessary to sustain its profitability. This involves reevaluating strategies, backtesting new approaches, and incorporating the latest in technological and analytical advancements.

In essence, creating a trading robot is a dynamic, iterative endeavor requiring a synergistic blend of trading expertise, analytical depth, and software development prowess. Success hinges not just on the initial setup but on an ongoing commitment to adapting and refining the system in line with evolving market conditions.

Automated trading is increasingly recognized for its superiority over manual trading, offering distinct advantages that enhance its efficacy in the financial markets. Below are key reasons why automated trading is considered more advantageous:

Speed and Efficiency: Automated systems execute trades with a speed and efficiency that human traders can't match. They can analyze vast data across multiple markets in milliseconds, seizing opportunities instantly, reducing slippage, and securing trades at the most favorable prices.

Emotionless Decision-Making: A major benefit of automated trading is its immunity to emotional biases. Human traders often succumb to emotions like fear and greed, leading to inconsistent decisions. Automated systems, however, strictly follow predefined rules, ensuring discipline even in turbulent markets.

Backtesting Capability: Automated trading enables thorough backtesting using historical data, allowing traders to assess a strategy's viability and profitability before employing real capital. This also facilitates strategy optimization for enhanced performance, a feat less systematic in manual trading.

Diversification and Risk Management: Automated systems can simultaneously monitor and trade across multiple markets, achieving a level of diversification hard for manual traders. This not only spreads risk but also improves the chance for consistent returns. Additionally, they can apply complex risk management tactics in real-time to mitigate exposure to volatility.

Consistency and Discipline: By executing strategies consistently and without the temptation to overtrade, automated trading provides a clear measure of a strategy's effectiveness over time. It maintains discipline by adhering strictly to entry and exit criteria, position sizing, and other strategy parameters.

Scalability: Automated systems can scale operations effortlessly, managing more trades without compromising performance. This scalability supports efficient trading activity expansion, a challenge for manual traders due to physical and temporal limitations.

Market Monitoring: Capable of 24/7 market surveillance, automated trading ensures no opportunity is missed, a feat impossible for individual traders due to human limitations like the need for rest.

Although automated trading presents numerous benefits, it's not devoid of challenges, such as the necessity for ongoing monitoring to prevent technical issues and the risk of over-optimization during backtesting. Nevertheless, the precision, speed, and discipline of automated systems often lead to superior outcomes compared to manual trading methods, solidifying their position as a vital tool for contemporary traders.

Abele11 –

Excellent bot! Highly recommended!

Tommy B –

From what I understand, this Algo trading bot utilizes a Swing trading system. It’s a fantastic trading style that will always be relevant. By the way, it’s a Prop Firm EA, which you can use for prop trading!

ArianTRADER –

I think this is my best purchase this year! I use it for trading on my private account as well as for prop trading.

Pierre12FF –

I have four expert advisors that I’ve purchased from this site. This Algo trading robot has shown the best results!

Christophe T –

I recommend this algo trading bot to anyone looking for good profits with minimal risk. I believe that describes most of us. So, I highly recommend this software for algorithmic trading to everyone!

Vincent R –

This is one of the few Forex bots that trades without using martingale and still achieves good profits. By the way, this expert advisor also employs a Stop Loss. So, if you’re looking for safe software, you should definitely buy this one!

LeonPride –

I was expecting a lot more. Perhaps I am rushing to conclusions, but the first week with this algo bot didn’t impress me!

ChiaraB –

Hello, traders! This is the first trading robot I’ve ever bought, and the great news for me is that it’s genuinely profitable—a bot I can recommend to other traders! I highly recommend it!

1ker –

This is an excellent Forex Algo EA, but sometimes there are days when this software is waiting for new signals and does not trade. this waiting period may last 2-3 days.

BenvenutoREX –

This is the best Forex expert advisor in my portfolio! How does this software trade? This algo bot generates significant profits with minimal drawdowns! My trading account has increased by 50% in just a couple of months!