Download and unzip

In the confirmation letter that you received by email after the purchase, there is a link to download the product. Download this archive to your PC and extract it. If there is no archiver, use this free archiver – 7zip archiver.

Next, follow the instructions:

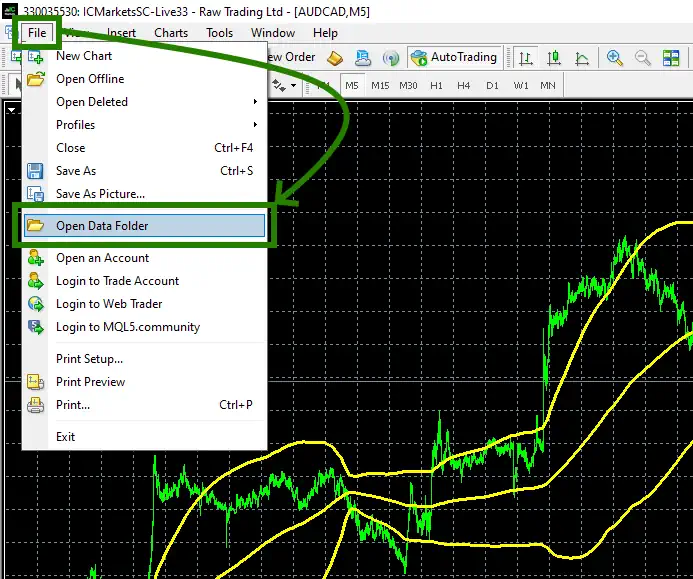

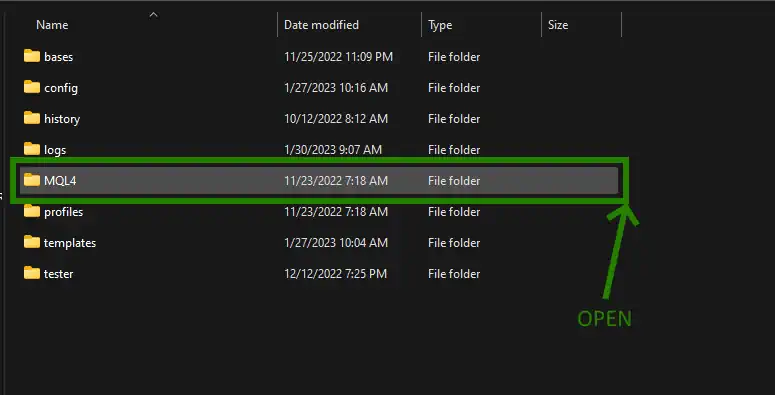

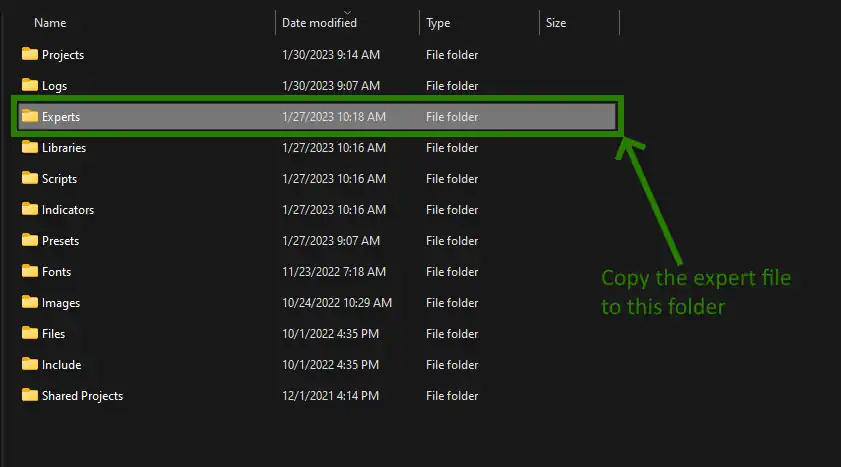

Copy the advisor file to the MT4 root directory

Install the North East Way EA file in the MT4 trading platform. Follow the instructions in the pictures below:

Open the “MQL4” folder inside the root directory of your platform and find the “Experts” folder inside

Restart your MT4 platform

This is necessary for any changes you make to take effect.

Trading portfolio

North East Way EA is a multicurrency trading robot. It can work on different assets. Namely:

- Base currency pairs: AUDNZD, NZDCAD, AUDCAD

- Additional currency pairs: EURGBP, EURUSD, GBPUSD, USDCAD, GBPCAD, EURCAD.

If your deposit is up to $2000, then use the Basic Portfolio. If your deposit is more than $5000, then you can add additional currency pairs.

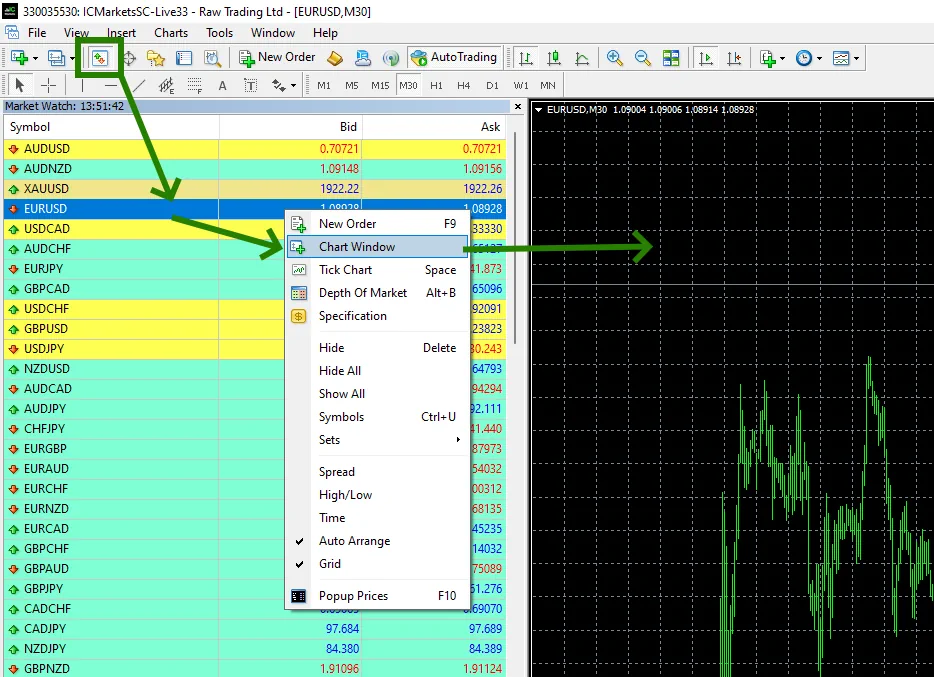

So, open the currency pairs you have chosen to trade.

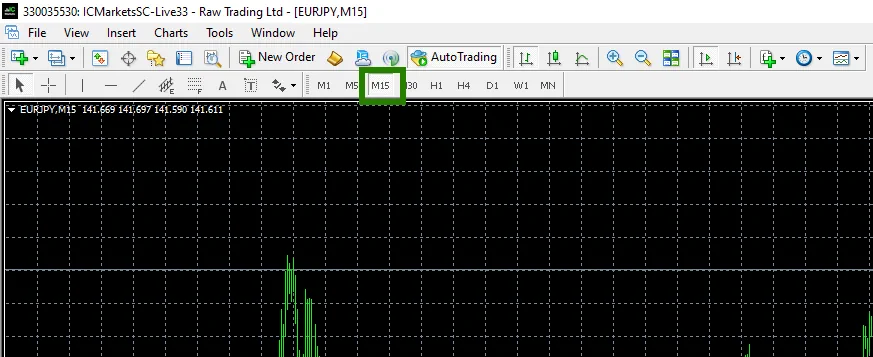

Set the M15 timeframe for quote chart:

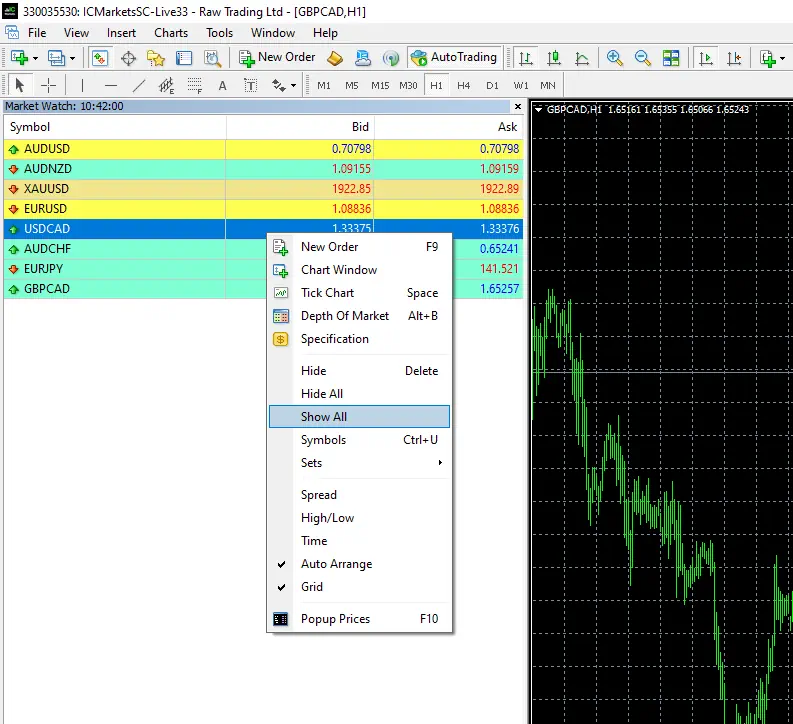

If some assets do not appear in the list of available assets, you need to right-click on the list of assets and select the “Show all” option:

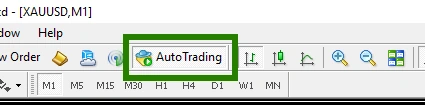

Activate the “Auto Trading” button:

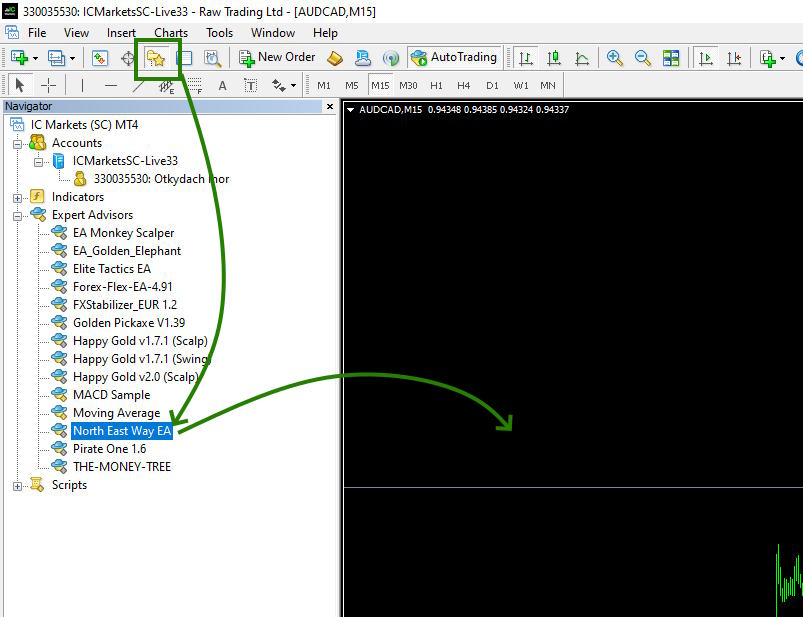

Open the “Navigator” folder, find the North East Way EA in the “Experts” folder and drag it onto the quote windows for each asset:

After that, the adviser will activate and will be ready for trading and will start making deals soon.

Please note that the EA does not trade every day. He is waiting for the moments when the local market trend on the M15 unfolds. It doesn’t happen every day, unfortunately. Therefore, if sometimes North East Way EA trades once a week, this is normal. Although there are weeks when this EA trades every day. It all depends on the situation in the asset market. The greater the volatility, the more trades the trading robot will make.

Risk management

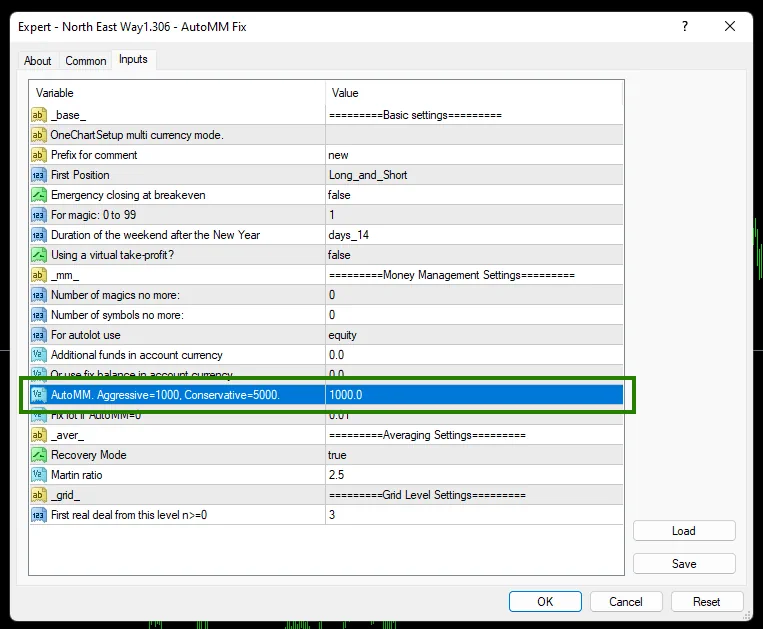

To change the size of the trading risk, set the calculated value at which the trading risk will increase by 0.01 lots.

For example, if you set the variable (which we displayed in the picture below) to 1000, then the adviser will increase the trading risk by 0.01 lots for every 1000 deposit units. That is, if your deposit is $5,000, then the starting lot will be 0.05.