Download and unpack the archive with the product

Each buyer receives a product file and instructions on how to install and use by email after making a purchase. Download archive with product to your PC and extract it. If you do not have an archiver, use this free program – 7zip archiver.

Next, follow the instructions below.

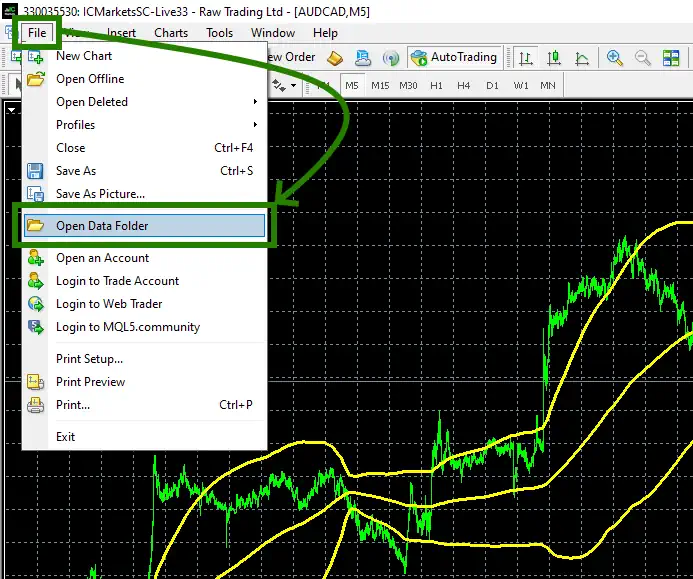

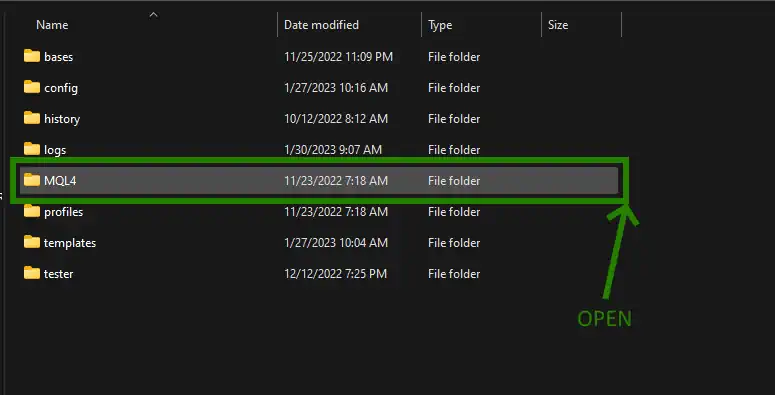

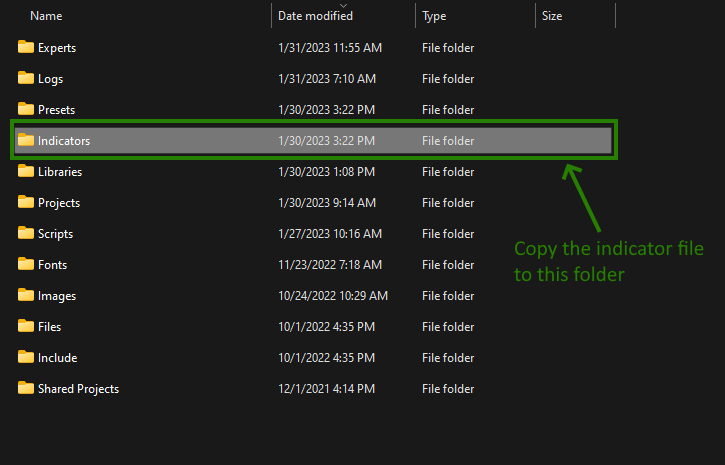

Copy the indicator to the MT4 root directory

Open the root directory of your MetaTrader platform and copy the Golden Elephant Expert Advisor file to the “Indicators” folder. Follow the instructions in the pictures below:

Open the “MQL4” folder inside the root directory of your platform and find the “Experts” folder inside

Restart your MT4 platform

This is necessary for any changes you make to take effect.

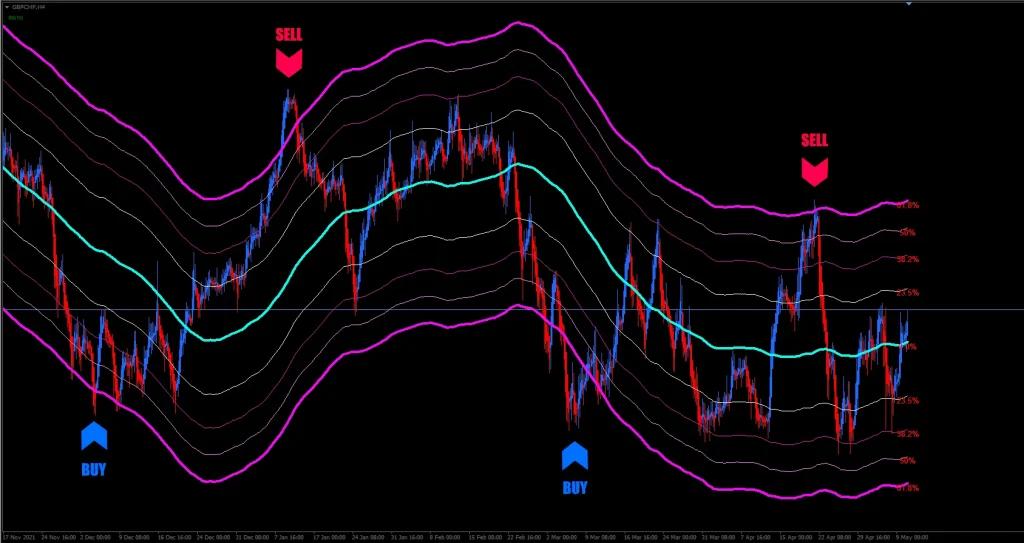

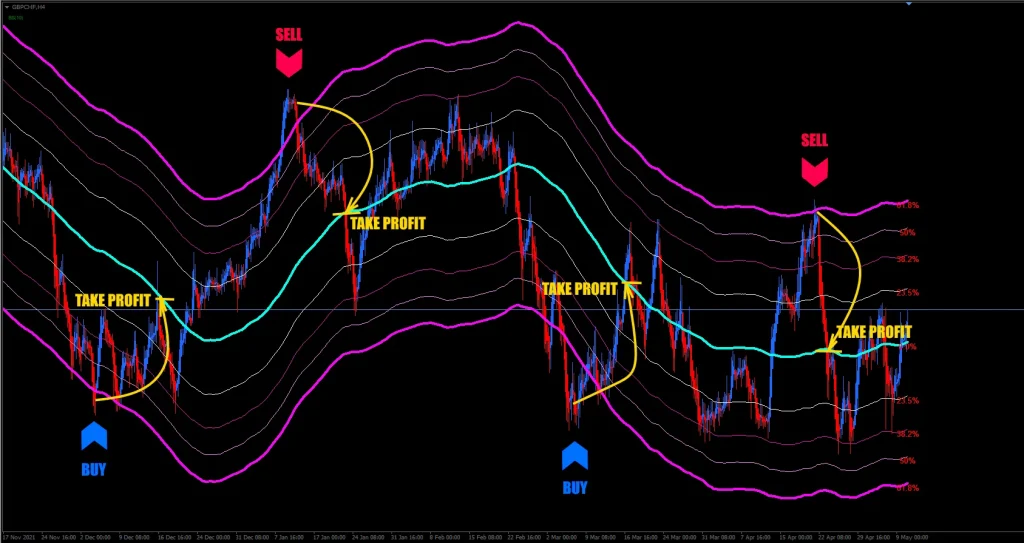

Primary deals for a price reversal in the channel

So, the most important levels of our price channel are the extreme boundaries of the channel. As we noted above, the main orders of market participants are located at such levels.

The upper limit of the channel is the level for BUY deals

At the upper level of our adaptive price channel, there are bear orders (which cause quotes to move down). Accordingly, when this upper level of the price channel is reached, the quotes are most likely to turn around and start moving down. So, the upper level of the price channel indicator is the level for sales.

The lower border of the channel is a place for SELL deals

At the lower level of our adaptive price channel, there are bull orders (which force quotes to move up). Accordingly, when this lower level of the price channel is reached, the quotes are most likely to turn around and start moving up. So, the lower level of the price channel indicator is the level for purchases.

The central line of the adaptive channel is a place for profit–taking

The central level of our channel indicator is located at the level of the moving average. According to the generally accepted rule, no matter how the price moves, it always tends to its average value, that is, to the center of its price channel. If you pay attention, then most often the quotes of any asset revolve around their average. Accordingly, we can say that after the quotes rebound from the upper or lower level of the price channel, the quotes will return to the center of the channel. It is logical that if we conclude deals for a rebound from the channel boundaries, then the best place to fix the profit will be the central line of the price channel. After all, asset quotes are most likely to return to this level according to the laws of gravity of the financial market (quotes tend to their average value).

So, the central level of the price channel indicator is the best level for fixing profit.

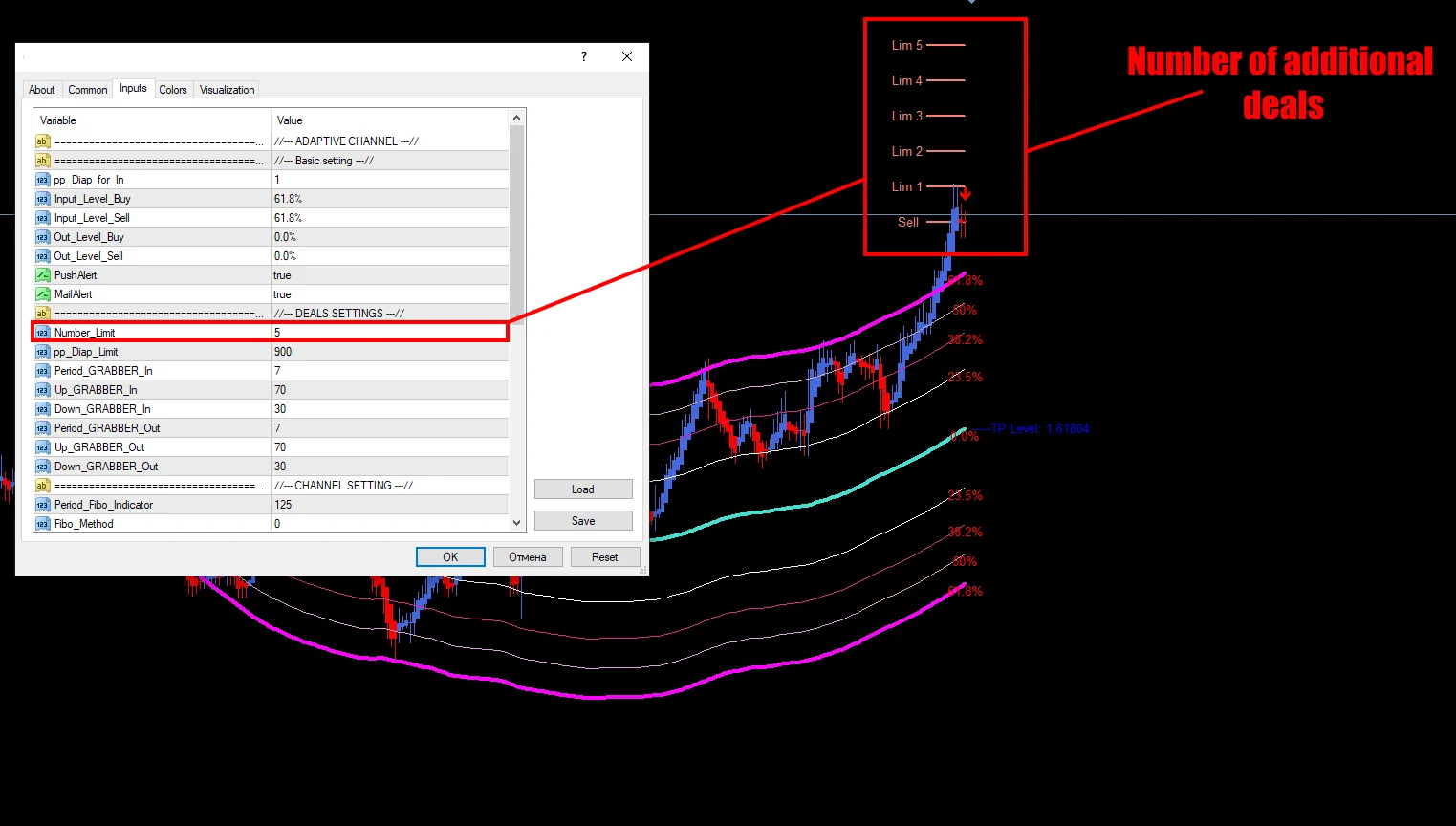

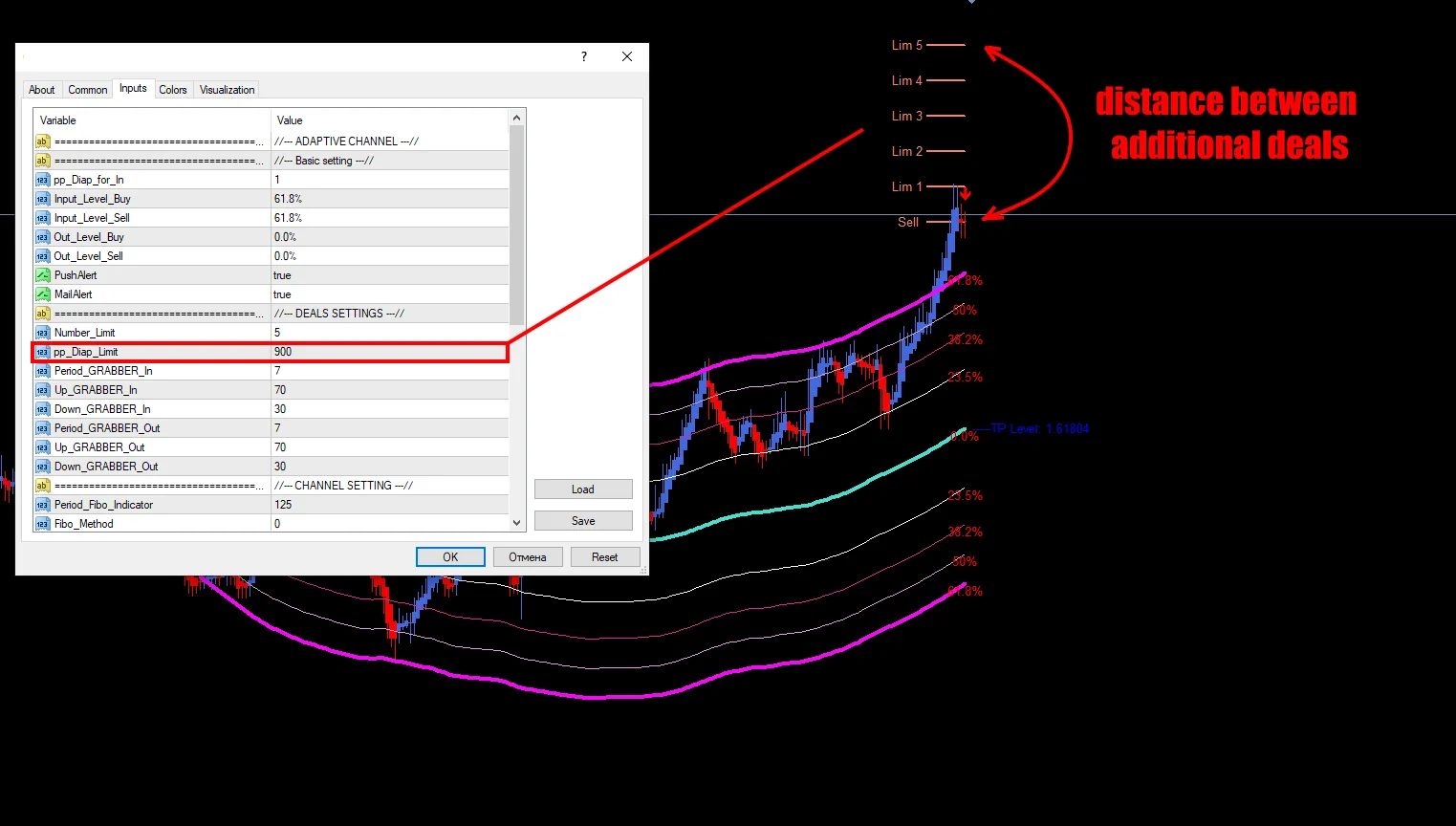

Additional deals

Our indicator adapts to all emerging market conditions, and we must take care to adapt our trading operations to the new indicator signals in time. To do this, we have developed a grid averaging system (make-up tactics) for those cases when a huge market force (a large accumulation of bull or bear orders) moves quotes much higher or lower from the boundaries of the price channel. At such a moment, there is an opportunity to make additional transactions at a more favorable price. After all, quotes always tend to their average value and there will come a moment when the market will turn around and the price will touch the average level of the adaptive channel. Accordingly, we will be able to record profits on several trading positions at once.

Inside the manual settings of our channel indicator, there are settings for calculating the location of adding several additional trades.

Variable “number limit” allows us to determine the number of additional deals.

Variable “diap limit” allows us to determine the distance in points between additional transactions. Thus, we program the indicator in advance so that in the future it will show us the levels where we need to add another buy deal or another sell deal.

The price channel indicator will show us these levels immediately after the quotes reach the boundaries of the price channel and you will have an opportunity to trade.

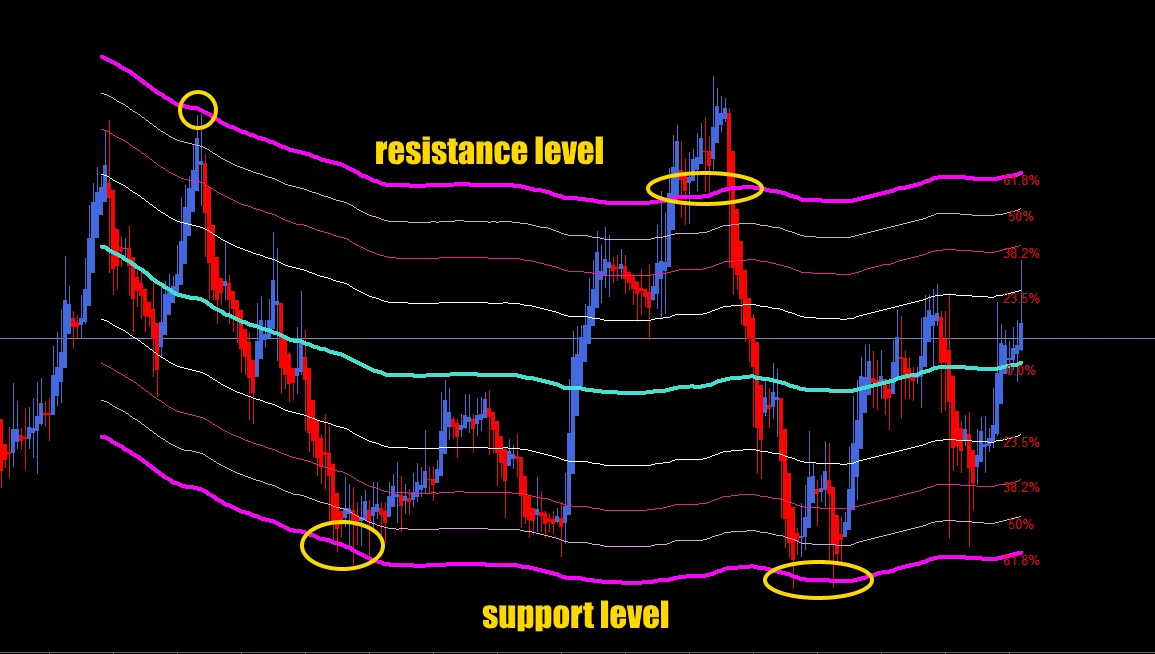

What do the price channels tell us?

As you know, price channels give us an understanding of the dynamics of price movement. Its boundaries are longer than the waves of growth and fall. With the help of price channels, we can say with a huge degree of probability how the asset quotes will move in the future – fall or grow. Accordingly, if a trader has such information about the direction and length of the price wave in the future, he can make a deal in the right direction and make a profit.

Most importantly, price channels help you identify support and resistance levels, which are fundamental to any trading strategy. After all, such levels allow us to determine the ideal entry and exit points on the chart.

On this page we have said the words support and resistance many times. Let’s pay special attention to these terms. In the future, you will often focus on these levels.

The support level is a key area from which the price usually bounces back up. Where do such levels come from? At these levels, buy orders are concentrated for traders who trade in the direction of asset growth. In simple words, in the place where the price bounces up, bulls (traders trading for an increase in the price of an asset) usually buy an asset or bet on an increase in its price.

The resistance level is a level where orders to sell bears (traders who trade to lower the price of an asset) are concentrated. In simple words, market bears usually sell their assets at this level.

And as for the strength of the market itself. The more buyers are active, the stronger the quotes move up. The more sellers are active, the more quotes move down. That is, the power of supply and demand is the real driving force of the market. Thus, our adaptive price channel indicator shows a real channel with real boundaries on which sellers will be most active (we can predict that a price decline will begin at this level) or buyers (we can predict that quotes will begin to grow at this level).

The best conditions for trading

If you are trading on a channel strategy, then you should remember a few fundamental rules. These rules will always work on almost any asset, namely:

- The higher the timeframe, the more accurate the channel indicator signals.

- There are trend assets on which you will receive less profit and flute assets on which you will receive more profit.

- Trading time also matters – the beginning of the European session and the beginning of the American session are not the best time to trade. At this time, a trend is observed on most assets.

- For trading, it is best to choose brokers that give good leverage so you can easily add additional transactions without much risk to your deposit.

Now let’s look at each rule in more detail…

The best timeframe for trading

If you are a novice trader who has problems with the time to trade, and also needs time to analyze the market and make trading decisions, then we recommend that you start with timeframes H1 or H4. On such price channels, quotes move slowly and you will have time to do your daily business in addition to trading, and when a trading signal appears, you will have time to analyze, make a trading decision and conclude a deal.

As for the timeframes M1, M5 and M15, these are small timeframes where quotes move too fast. If you want to trade on these timeframes, you have to put aside all extraneous matters and stay at the computer all the time. This is the only way you will be able to see the trading signal in time, make a deal and, most importantly, accompany it manually until it closes.

And another factor in favor of the higher timeframes is that there are fewer trend movements on H1 and H4, which are not very useful for scalping strategies in the price channel.

Flat assets

So, there are assets on which there is almost always a trend and price pullbacks do not have much depth – these are major currency pairs EURUSD, USDCHF, USDJPY, USDCAD. It is better not to include such assets in your trading portfolio. Do not worry, in addition to these currency pairs, there are a large number of assets where flat prevails or there are large price pullbacks. These can be currency pairs with GBP (GBPUSD, GBPCAD, GBPCHF, GBPAUD, GBPNZD), as well as currency pairs such as AUDCAD AUDCHF EURCHF CADCHF and so on. That is, most cross–rates will suit you for trading using the scalping strategy in the price channel. These are dozens of currency pairs, on the chart of each of which you will be able to make a profit. Cryptocurrencies are also suitable for trading in the price channel. Of course – including BTCUSD.

Time to trade

This rule is especially suitable for scalping on major currency pairs. Because all currency pairs have a direct dependence on the time of the trading session. Remember – the beginning of the European session and the beginning of the American session will bring you a surge of volatility with which a recoilless trend usually comes, which can bring you financial damage. So, if you want a calm trading without stress, then choose the second half of the American session and later.