FundedNext is committed to assisting traders in reaching their trading objectives. They concentrate on aiding clients who demonstrate discipline, robust risk management abilities, and a steady trading methodology over time. Traders have the opportunity to earn substantial profits, with the additional option of managing accounts up to $200,000 and enjoying profit shares between 60% to 95%. This opportunity includes trading a wide array of financial assets, including forex pairs, commodities, and indices.

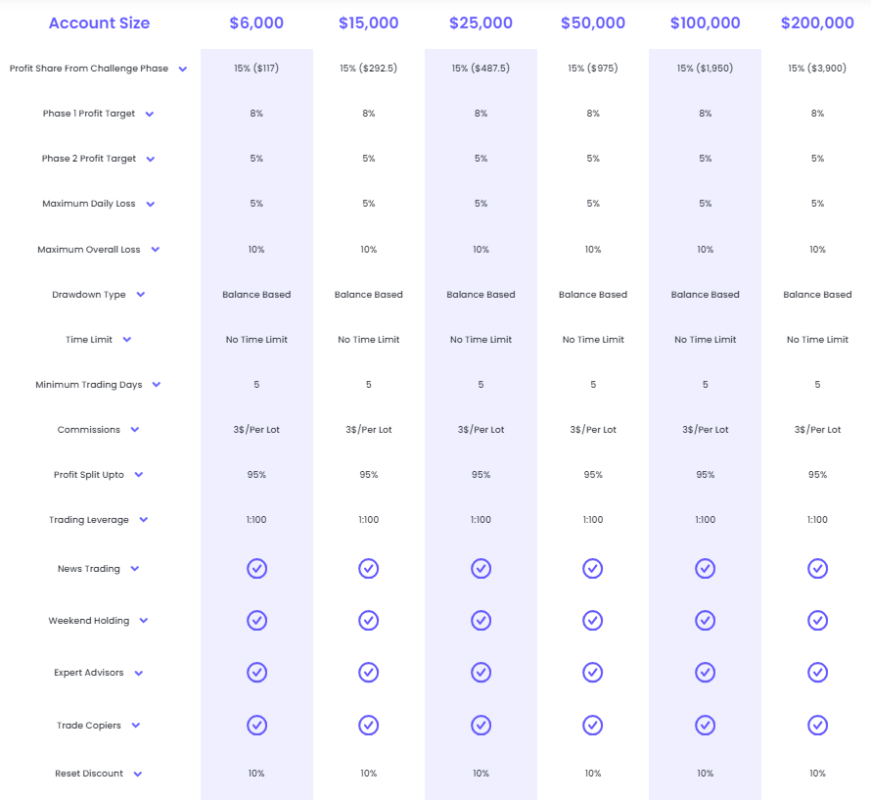

Basic information:

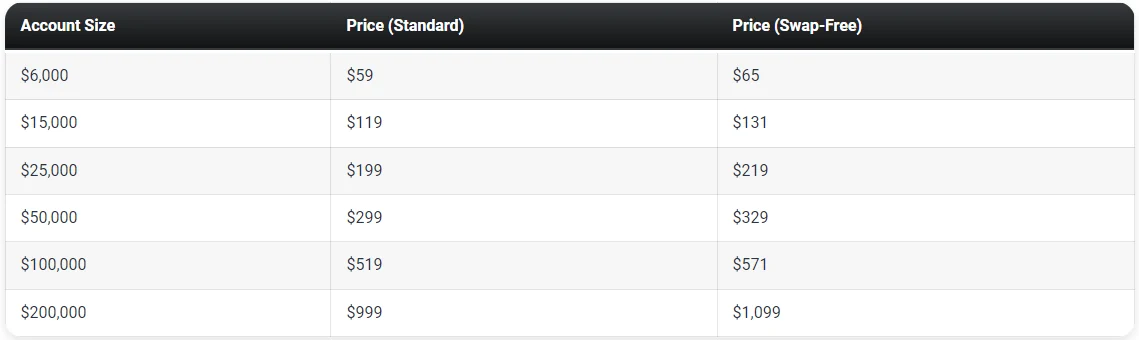

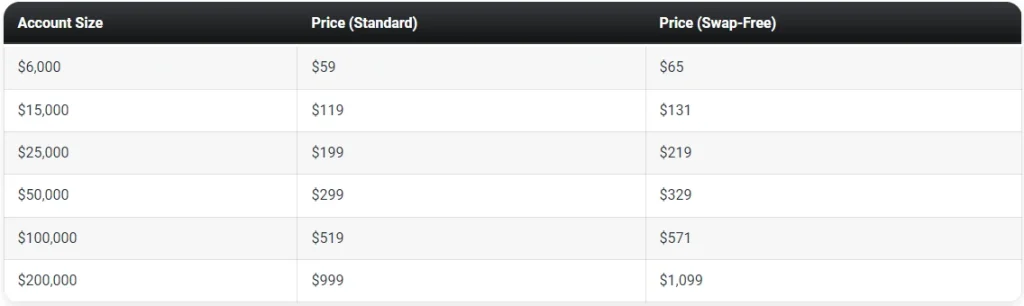

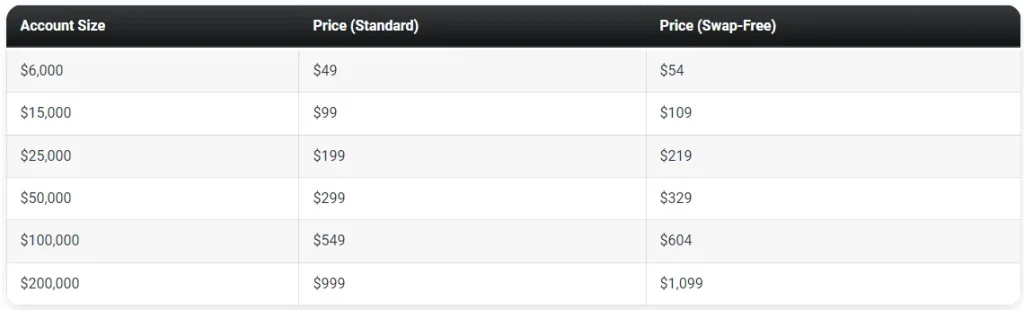

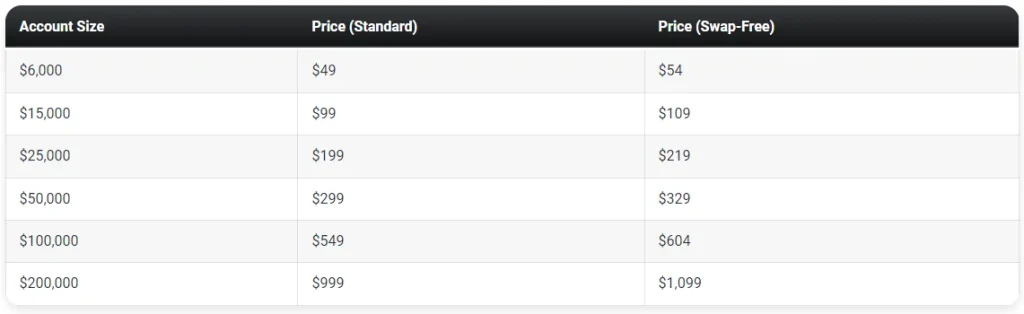

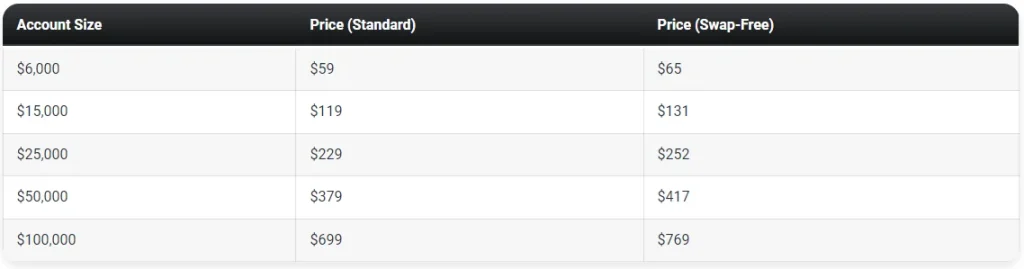

- Participation cost: from $59 to $999

- Profit Share up to 95%

- Leverage up to 1:100

- Available capital for management: from $6,000 to $200,000

- Minimum Trading Days – 5

- Initial Maximum Drawdown of 5%

- Funding Programs: Two-step Stellar, One-step Stellar, Evaluation Model, Consistency Express, Non-Consistency Express.

Two-step Stellar

FundedNext’s Two-step Stellar Challenge presents traders the opportunity to manage accounts ranging from $6,000 to $200,000. This initiative aims to identify traders who excel in profitability and risk management through two evaluative stages. Participants are allowed to trade with leverage as high as 1:100.

During the initial evaluative stage, traders are tasked with reaching a profit goal of 8% while keeping within a 5% daily loss and a 10% total loss limit. While there’s no fixed maximum number of trading days, participants must trade for at least five days to progress to the subsequent stage.

In the second stage, a 5% profit goal is set, with the same restrictions on losses as the initial phase. There is no set maximum duration for this phase either, but traders must complete a minimum of five days of trading to qualify for a funded account.

Achieving success in both stages grants traders access to a funded account, which comes with no restrictions on minimum withdrawals and adheres to the established 5% daily and 10% total loss parameters. The first payout is scheduled 14 days after initiating the first trade on the funded account, followed by the option of bi-weekly withdrawals. Traders can enjoy profit shares between 80% and 90%, plus an extra 15% profit share from each evaluation phase once a 5% return is realized on the funded account.

Scaling Plan for Two-step Stellar

Within the scaling strategy, traders who demonstrate consistent profitability over certain timeframes are eligible for a 40% increment in their original account balance. Successfully scaling up for the first time also raises the profit share to 90%.

The trading regulations and goals for the Two-step Stellar Challenge encompass:

- Profit Objectives: During the evaluation stages, traders need to achieve designated profit percentages, with a 10% goal for Phase 1 and a 5% target for Phase 2. Funded accounts are not subject to predetermined profit objectives.

- Daily Loss Cap: All accounts are subject to a 5% maximum daily loss restriction.

- Overall Loss Limit: A cap of 10% total loss is applicable across all accounts.

- Minimum Trading Requirement: Traders must engage in trading for a minimum of five days during both evaluation phases.

One-step Stellar

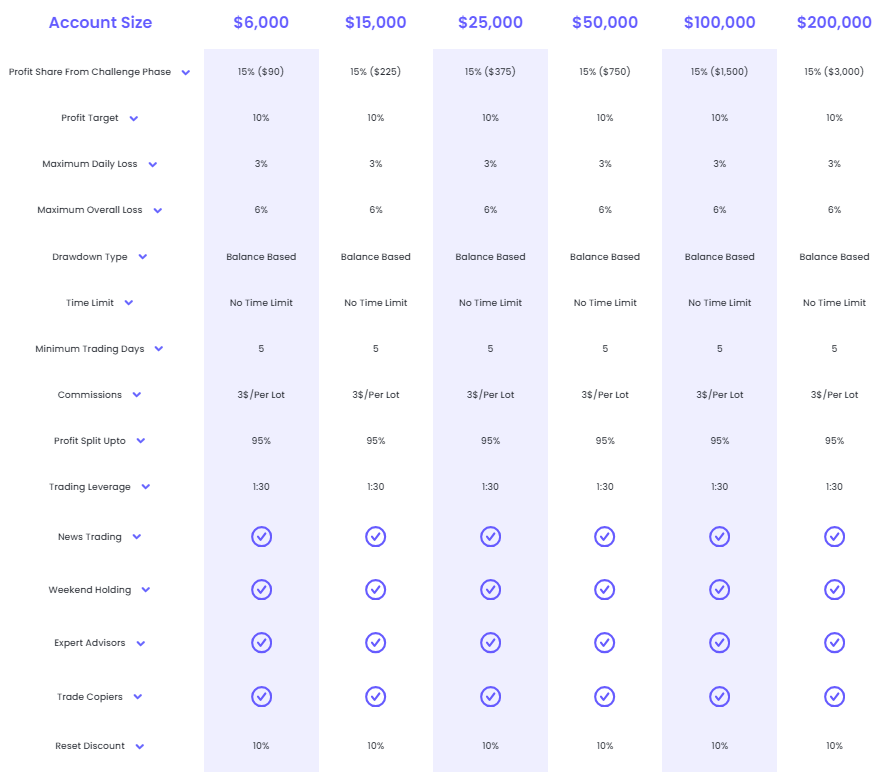

The One-step Stellar Challenge by FundedNext presents an opportunity for traders to manage accounts ranging from $6,000 to $200,000. The goal is to identify traders who demonstrate profitability and efficient risk management within a single evaluation phase. Participants in this challenge can trade with leverage up to 1:30.

In this evaluation, traders need to meet a 10% profit target while maintaining within a 3% maximum daily loss and a 6% total loss limit. While there’s no fixed maximum duration for trading during this phase, a minimum of five trading days is required to progress to a funded account.

Successfully completing the evaluation phase allows traders access to a funded account with no restrictions on minimum withdrawals. Traders are expected to adhere to the 3% daily and 6% total loss limits. The first payout is arranged for 14 days after the initial trade on the funded account, followed by options for bi-weekly withdrawals. Profit shares are allocated between 80% and 90%, based on the trader’s performance on the funded account. Moreover, a 15% share of the profits from the evaluation phase is awarded once a 5% return on the funded account is accomplished.

Scaling Strategy for the One-step Stellar Challenge

The One-step Stellar Challenge includes a scaling strategy tailored for traders who consistently show profitability. Traders who sustain profitability for at least two quarters within a period of four months, either by securing an average return of 10% over three months or maintaining a monthly return of 2.5% over four months, are eligible for a 40% increase in their original account size.

Following the initial successful scale-up in their One-step Stellar Challenge, the trader’s share of the profits increases to 90%.

Guidelines & Goals for the One-step Stellar Challenge

- Profit Objective: Traders must achieve a specified profit threshold to successfully complete the evaluation phase and unlock their earnings or increase their trading capacity. A profit goal of 10% is set for the evaluation phase, while funded accounts do not have set profit objectives.

- Daily Loss Limit: To safeguard their accounts, traders face a restriction of a 3% maximum loss in any single day across all account types.

- Total Loss Limit: All accounts are subject to a maximum total loss cap of 6%, ensuring traders remain within the acceptable loss range.

- Minimum Trading Requirement: To move forward successfully, traders must engage in trading for at least five days during the evaluation phase.

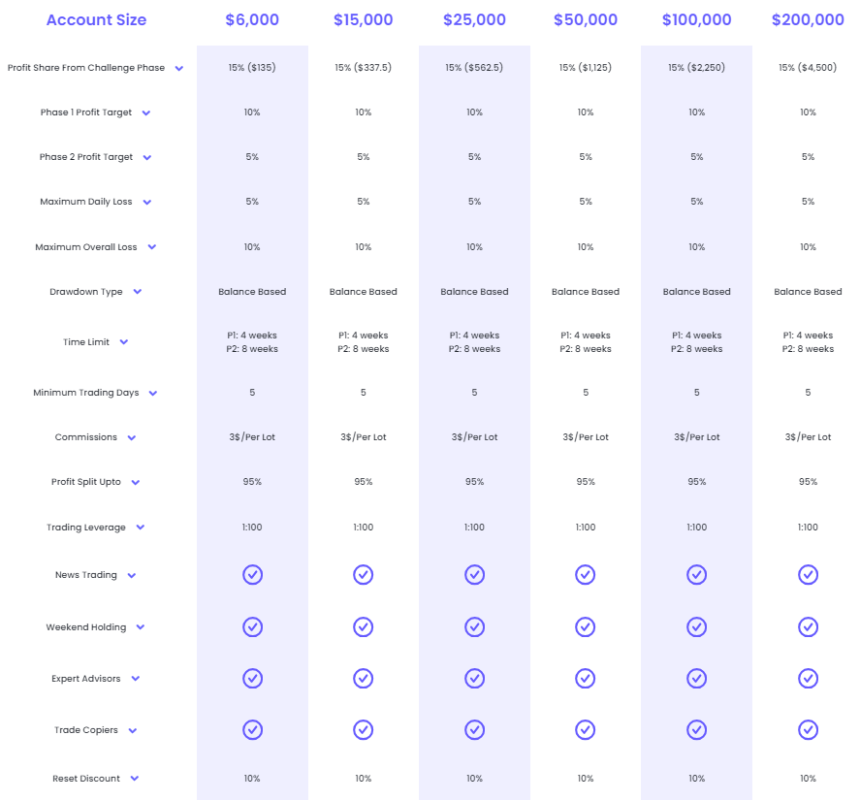

Evaluation Model

FundedNext’s Evaluation Program provides traders the opportunity to manage accounts ranging from $6,000 to $200,000. The aim is to identify proficient traders who can consistently produce profits and effectively manage risks throughout a two-stage evaluation period. This program allows for trading with up to 1:100 leverage.

During the initial evaluation stage, traders must reach a 10% profit target while maintaining within a 5% maximum daily loss and a 10% total loss threshold. They have a 4-week period to achieve this target and are required to trade for a minimum of 5 calendar days to progress to the subsequent phase.

The second phase of evaluation sets a 5% profit objective, with identical daily and overall loss constraints as the first phase. Participants have 8 weeks to meet this goal and need to engage in trading for at least 5 calendar days to qualify for a funded account.

On successfully navigating both phases, traders gain access to a funded account without any restrictions on the minimum withdrawal amount. They must adhere to the 5% daily and 10% total loss limits. The first withdrawal opportunity is provided 14 calendar days after initiating the first trade in the funded account, followed by the possibility of bi-weekly withdrawals thereafter. Profit shares range from 80% to 90%, depending on the performance in the funded account. Additionally, traders receive a 15% profit share from each evaluation phase once they achieve a 5% return on the funded account.

Expansion Approach for the Evaluation Framework

The Evaluation Framework features an expansion approach tailored for proficient traders. Traders who have consistently realized profits over two of the previous four months, achieving an average return of 10% over three months or maintaining a 2.5% return each month for four months, are eligible for a 40% boost to their starting account size. With the initial successful expansion under the Evaluation Framework, the profit share increases to 90%.

Trading Guidelines & Objectives for the Evaluation Framework

- Profit Objective: Traders need to reach a designated profit level to successfully conclude an evaluation phase, unlock their earnings, or enhance their trading account. The first phase requires a 10% profit achievement, while the second phase sets a 5% target. Funded accounts do not have prescribed profit objectives.

- Daily Loss Maximum: A 5% limit is imposed as the maximum loss a trader can experience in any single day for all account sizes, to safeguard the account’s integrity.

- Total Loss Cap: A comprehensive loss ceiling of 10% is applied to all accounts, indicating the maximum allowable loss.

- Minimum Trading Duration: Traders are obligated to engage in trading for a minimum of five days during each evaluation phase to advance successfully.

- Set Trading Timeframe: Participants are allotted a period of 4 weeks in the first phase and 8 weeks in the second phase to achieve their profit goals and finalize their evaluation.

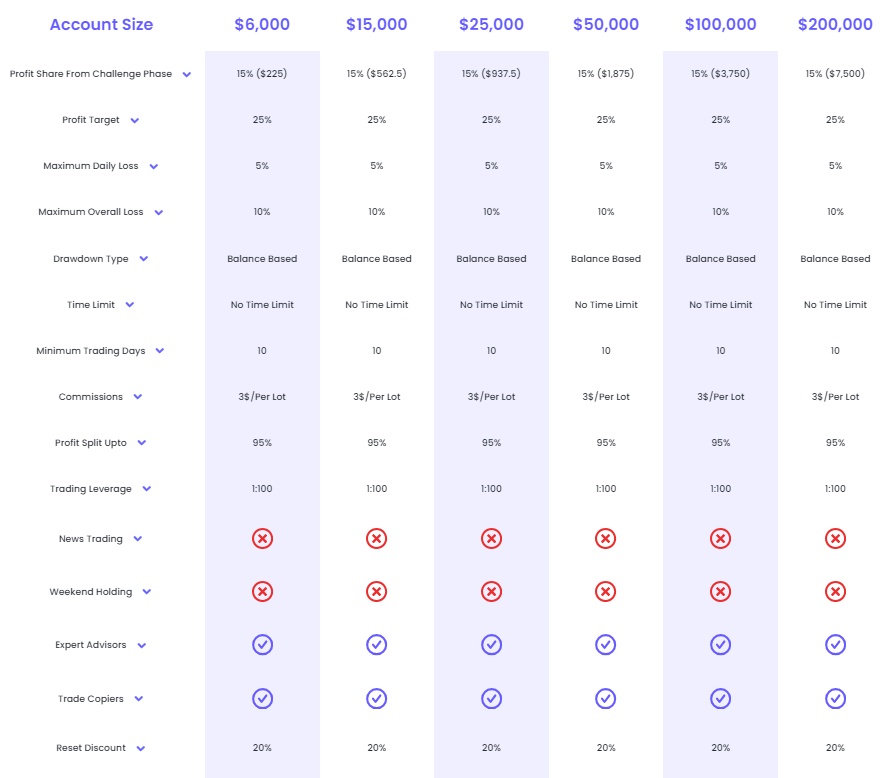

Consistency Express Model

The FundedNext Consistency Express Approach provides traders the opportunity to manage accounts ranging between $6,000 and $200,000. It aims to identify traders who are not just profitable but also demonstrate discipline and effective risk management during a single-phase evaluation. In this approach, traders have the option to trade with leverage up to 1:100.

In the evaluation process, traders are tasked with achieving a 25% profit target while adhering to a 5% maximum daily loss and a 10% total loss limit. While there’s no maximum number of trading days set for this phase, it’s mandatory to trade for at least 10 days to progress to a funded account. Consistency is key during this phase to foster good trading habits and steady profit growth until the target is attained. Every 4-week trading cycle, a 15% profit share from the earnings made during the evaluation phase is granted until the 25% profit aim is achieved.

Once the evaluation is successfully completed, traders are provided with a funded account, free from withdrawal limits. The constraints of 5% daily loss and 10% total loss continue to apply. Traders are required to maintain consistency and commit to trading for a minimum of 10 days in each monthly cycle. The initial share of the profits is 60%, based on the earnings generated. This percentage increases to 75% at the second withdrawal and further escalates to 90% from the third withdrawal onward.

Growth Approach for the Consistency Express Framework

The Consistency Express Framework features a growth approach tailored for traders who demonstrate consistent profitability. Traders who have maintained steady profits over at least two quarters within a recent four-month period, securing an average of 10% returns over three months or a regular 2.5% monthly return across four months, qualify for a 40% increase in their starting account size.

Guidelines & Objectives for the Consistency Express Framework

- Profit Objective: Traders are obligated to meet a predetermined profit benchmark to effectively conclude an evaluation phase, withdraw their profits, or expand their trading capacity. A 25% profit target is established for the evaluation phase, while funded accounts do not have explicit profit objectives.

- Daily Loss Limit: To prevent excessive losses in any single day, a cap of 5% daily loss is enforced across all account sizes.

- Total Loss Ceiling: A comprehensive 10% loss limit is applied to all accounts, indicating the maximum allowable loss.

- Minimum Trading Duration: Traders must participate in trading for at least 10 days during the evaluation phase and maintain this minimum in each monthly cycle.

- Weekend Position Closure: Positions must be closed before the market shuts on Friday, prohibiting any trades from being held over the weekend.

- High-Impact News Trading Prohibition: Trading is not permitted during times of significant news announcements.

- Consistency Mandate: Traders are required to adhere to a uniform trading strategy, encompassing consistent position sizes, risk management strategies, and trading results.

- Sudden and substantial variations in account performance metrics are discouraged. This mandate principally focuses on the consistency of trading days, trade volumes, and lot sizes.

Non-Consistency Express Model

FundedNext’s Alternative Consistency Express Framework offers traders the opportunity to manage accounts ranging from $6,000 to $100,000. The aim is to identify disciplined and profitable traders who are skilled at risk management during a one-step evaluation period. This framework provides the possibility to trade with leverage as high as 1:100.

During the evaluation stage, traders are expected to target a 25% profit while maintaining a 5% maximum daily loss and not exceeding a 10% total loss limit. There’s no set upper limit on the number of trading days for this stage, but a minimum of 10 trading days is required to progress to a funded account. Every 4-week cycle, a 15% share of the profits earned during the evaluation phase is distributed until the 25% profit objective is met.

Once the evaluation stage is successfully completed, traders are granted a funded account without any limits on the amount they can withdraw. However, they must continue to follow the 5% daily loss and 10% total loss guidelines. Additionally, a minimum of 10 trading days in each monthly cycle is compulsory. The initial profit share starts at 60% based on the profits earned, which then increases to 75% at the second withdrawal and eventually rises to 90% from the third withdrawal forward.

Expansion Plan for the Non-Consistency Express Framework

The Non-Consistency Express Framework introduces an expansion plan tailored for traders who show consistent profitability. Traders who achieve profitability for at least two quarters within a span of four months, either by securing an average of 10% returns over three months or maintaining a consistent 2.5% monthly return for the entire four months, are eligible for a 40% increase in their original account size.

Operational Guidelines & Objectives for the Non-Consistency Express Framework

- Profit Benchmark: Traders must meet a specific profit level to successfully complete an evaluation phase, access their profits, or increase their trading capacity. A 25% profit is the target for the evaluation phase, while funded accounts have no preset profit benchmarks.

- Daily Loss Maximum: To safeguard accounts, a 5% maximum daily loss limit is enforced across all account sizes to avoid significant losses in any single day.

- Overall Loss Limit: A global loss cap of 10% is established for all accounts to set the maximum allowed loss.

- Trading Day Minimum: A requirement of at least 10 trading days is set for the evaluation phase, with an ongoing minimum of 10 trading days in each monthly cycle thereafter.

- High-Impact News Trading Ban: Trading is prohibited during times when high-impact news is released.

- Uniformity Mandate: Traders are expected to maintain a consistent approach in their trading style, including position sizes, risk management, and trading outcomes. The framework discourages noticeable variations in the account’s performance indicators, emphasizing consistency in trading days, trade volumes, and lot sizes.

Is it Practical to Obtain Capital from FundedNext?

When evaluating proprietary trading firms and their compatibility with your forex trading strategy, considering the practicality of the trading requirements is crucial. Even though a firm may present attractive profit shares on large funded accounts, the practicality might decrease if they impose high monthly profit targets along with stringent maximum drawdown percentages, thereby narrowing the probability of success. The presence or absence of time constraints is also significant, as unlimited trading durations allow more flexibility and reduce pressure from deadlines. Moreover, a comprehensive understanding of all the trading rules during both the evaluation and funding stages is essential to prevent accidental violations of your account’s conditions.

- Acquiring funds through the Two-step Stellar Challenge is considered practical because of its reasonable profit objectives (8% in phase one and 5% in phase two) and standard maximum loss rules (5% daily and 10% overall maximum loss). Importantly, this challenge doesn’t enforce a cap on trading days but requires a minimum of 5 calendar days of trading. Completing both evaluation phases opens up the potential for earnings with a generous profit share of 80% to 95%.

- Securing capital via the One-step Stellar Challenge is seen as achievable with its standard 10% profit target and typical maximum loss limits (3% daily and 6% overall maximum loss). Similar to the Two-step, it doesn’t impose maximum trading day restrictions and requires a minimum of 5 calendar days of trading. Success in the evaluation phase leads to profit payouts with a share of 80% to 95%.

- Attaining funds through the Evaluation Model is feasible, largely due to its sensible profit goals (10% in phase one and 5% in phase two) along with standard maximum loss rules (5% daily and 10% overall maximum loss). This model includes a maximum trading duration of 4 weeks in phase one and 8 weeks in phase two, with a requirement for at least 5 calendar days of trading. Successful completion of both phases results in eligibility for payouts with an attractive profit share of 80% to 95%.

- Gathering capital from the Consistency Express Model is possible, particularly with its slightly elevated profit target of 25% coupled with standard maximum loss rules (5% daily and 10% overall maximum loss). This model doesn’t specify a maximum number of trading days but requires a minimum of 10 calendar days of trading, adherence to consistency rules, and prohibits weekend holding. Finishing the evaluation phase grants traders a profit split ranging from 60% to 95%.

- Obtaining capital via the Non-Consistency Express Model is also deemed practical, given its higher 25% profit target and standard maximum loss parameters (5% daily and 10% overall maximum loss). Without a maximum trading day limit but with a 10-day minimum trading obligation, successful completion of the evaluation phase leads to earning opportunities with a profit share of 60% to 95%.

Considering all aspects, FundedNext emerges as a viable choice with its five unique funding programs, including two two-step and three one-step evaluations. Each scheme presents achievable trading targets and conditions for qualifying for payouts.

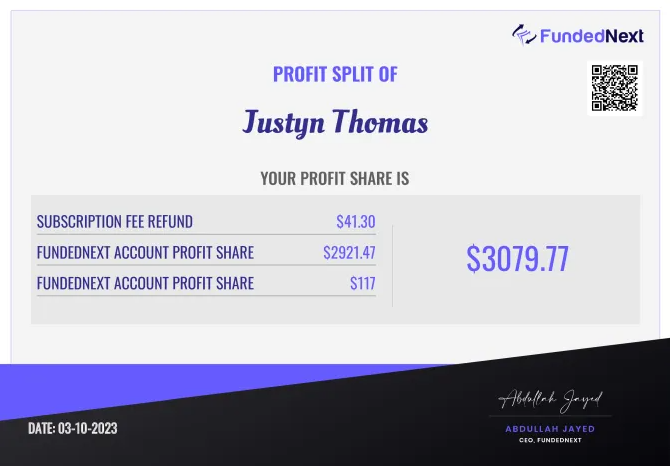

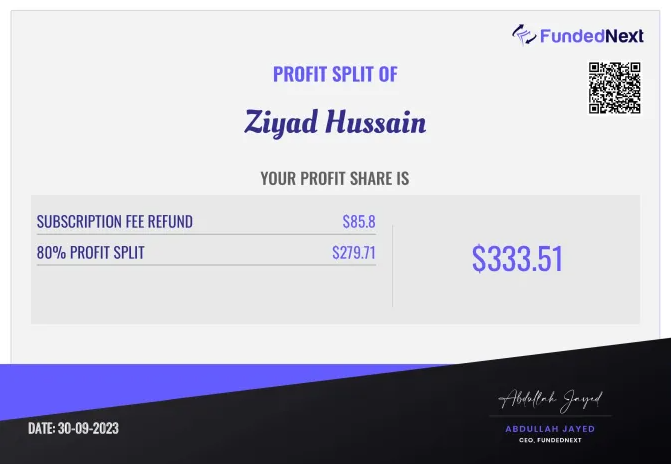

Verification of Disbursements

Inaugurated on March 18, 2022, FundedNext is a proprietary trading firm with a large community of traders who have achieved funded status, thereby qualifying for a portion of the profits earned.

As a trader affiliated with FundedNext, once you reach funded status via any of their schemes such as the Two-step Stellar Challenge, One-step Stellar Challenge, Evaluation Model, Consistency Express Model, or Non-Consistency Express Model, you are eligible to receive your first disbursement after a 14-day calendar period. After your initial disbursement, subsequent payments are issued every 14 days, as long as your profits surpass the original account balance. The profit division offered to you varies between an impressive 80% and 90%, indicative of the profits accrued in your funded account.

For those interested in authenticating FundedNext’s disbursement procedures, several platforms showcase testimonials and proof. Trustpilot provides reviews from traders sharing their payout experiences and successful transactions with the company. Furthermore, FundedNext’s Discord server, YouTube channel, and Instagram account are rich sources of disbursement certificates and conversations with some of their most successful traders.

Below, you’ll find images that serve as examples of Disbursement Certificates and proofs of payments.