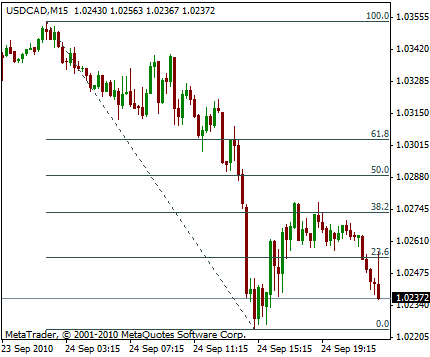

Fibonacci Retracement is a vital tool in Forex trading, allowing traders to anticipate potential support and resistance levels based on mathematical ratios derived from the Fibonacci sequence. This tool is a mainstay in the technical analysis toolkit, essential for those involved in Fibonacci Forex trading.

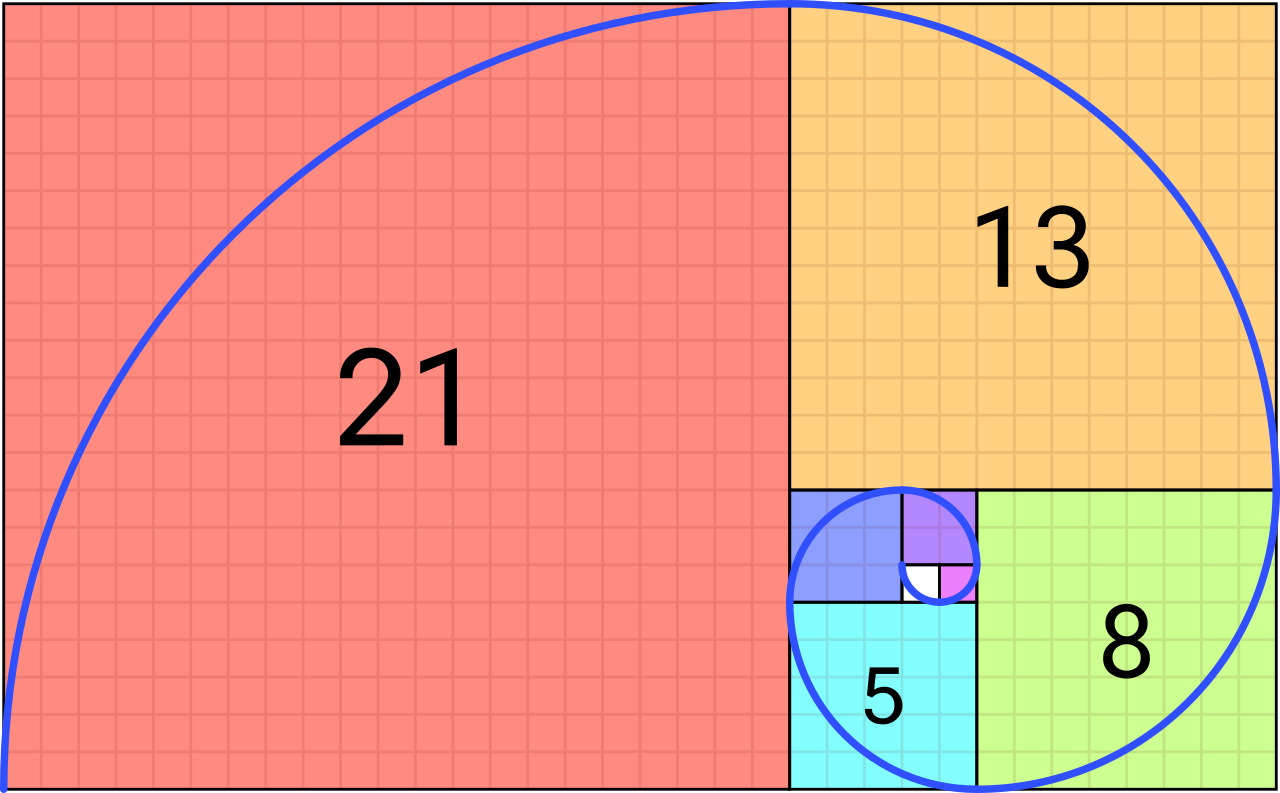

The Essence of Fibonacci Sequence in Trading

The foundation of Fibonacci extensions lies in the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones. In the context of Forex, these numbers are transformed into percentages and are used to predict possible reversal points in the currency market, a technique often referred to as 'Fibonacci Forex.'

Implementing Fibonacci Retracement

In practice, Fibonacci retracement involves identifying high and low points during a currency pair's price movement and drawing horizontal lines at the key Fibonacci levels (23.6%, 38.2%, 50%, 61.8%, and sometimes 76.4%) on the chart. These lines represent potential areas of support or resistance where traders can expect price pullbacks or reversals.

Strategic Use of Fibonacci Retracements

Forex traders use Fibonacci extensions to gauge potential entry points during pullbacks in an ongoing trend. These levels often act as 'psychological' barriers in the market, offering traders clues about future price movements. It's a common strategy to place buy orders near the Fibonacci support level in an uptrend or sell orders near the Fibonacci resistance level in a downtrend.

Fibonacci Retracement and Risk Management

One of the key advantages of using Fibonacci retracement in Forex trading is its role in risk management. Traders often set stop-loss orders just beyond the identified Fibonacci levels to minimize potential losses if the market moves against their predictions.

Combining Fibonacci Retracement with Other Tools

While Fibonacci extensions is powerful, it's typically used in conjunction with other technical analysis tools like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) for more robust trading strategies.

Conclusion: A Tool for Enhanced Forex Trading

Fibonacci retracement serves as an indispensable tool for Forex traders, providing a deeper understanding of market dynamics and aiding in making informed trading decisions. It's a blend of mathematical precision and trading artistry, integral to the repertoire of successful Forex traders.