Download and unpack the archive with the product

Immediately after payment, you received an email confirming your order and links to download the manual and archive with the Advanced Parrot Scalper product. Download the product archive to your PC and unzip it. To unpack the archive, you can use this free program – 7zip archiver.

Next, follow the instructions below.

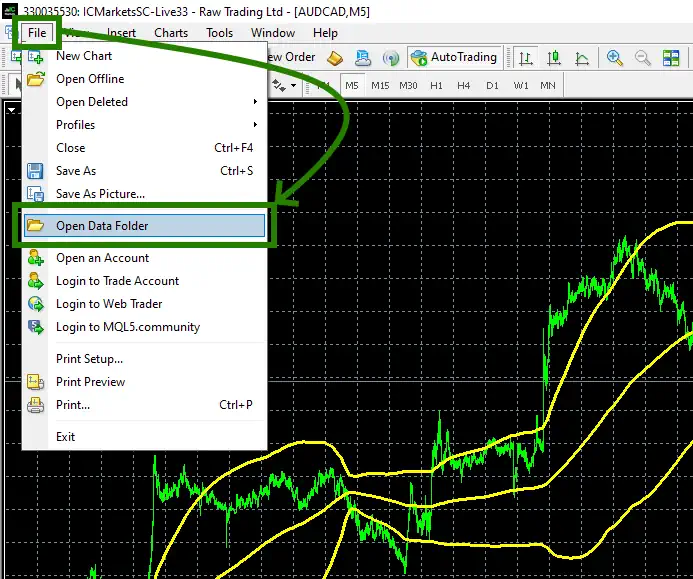

Open the MT4 root directory

Find the “File” menu item in the upper left corner of your platform and click on “Open Data Folder” in the drop-down menu. This will open the root directory of your MT4 platform:

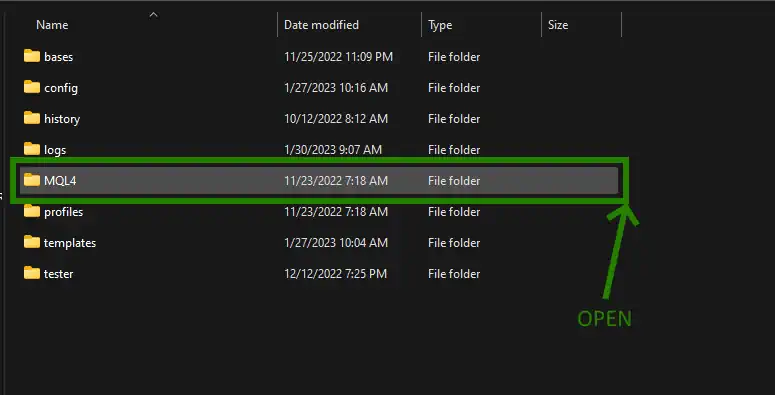

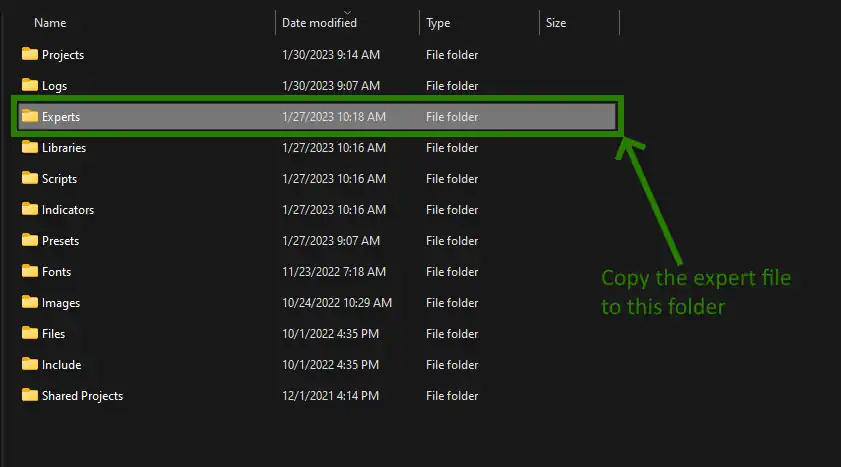

Open the “MQL4” folder inside the root directory of your platform and find the “Experts” folder inside

Copy the Advanced Parrot Scalper file inside the “Experts” folder:

Restart your MT4 platform

This is necessary for any changes you make to take effect.

Assets for trading

According to the author’s recommendations, this EA works best on currency pairs:

- EURUSD,

- GBPUSD,

- EURJPY,

- EURGBP.

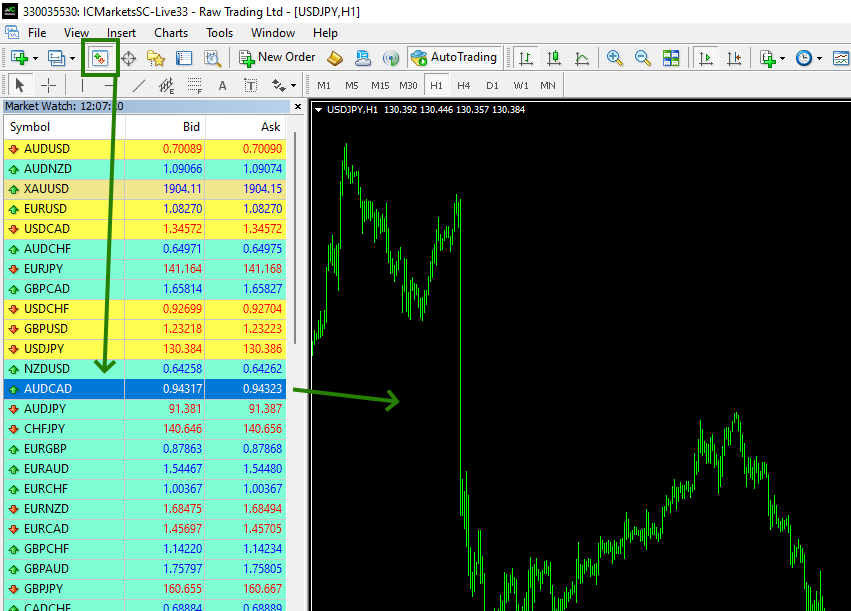

However, as practice shows, this Expert Advisor works well on other cross-rates, such as AUDCAD, NZDCAD, and others. Also, you can try Parrot Scapler on other assets. Before that, do a test using the MT4 strategy tester. If the test results satisfy you, then you can use this asset to create a trading portfolio. So, for starters, open one of the assets for trading. For example – the AUDCAD currency pair:

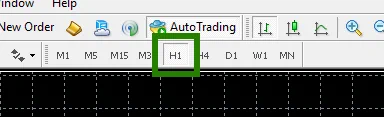

Set the H1 timeframe for each open quote chart:

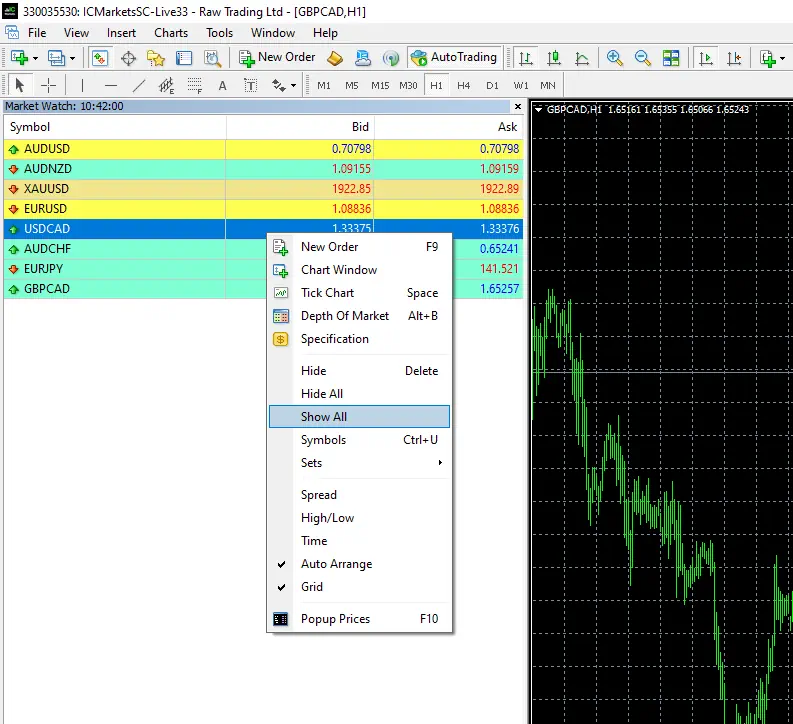

If some assets do not appear in the list of available assets, you need to right-click on the list of assets and select the “Show all” option:

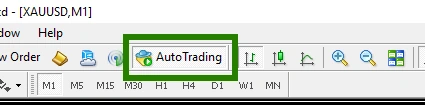

Activate the “Auto Trading” button:

Open the “Navigator” folder, find the Advanced Parrot Scalper in the “Experts” branch and drag one by one to all the quote windows that you have prepared for trading.

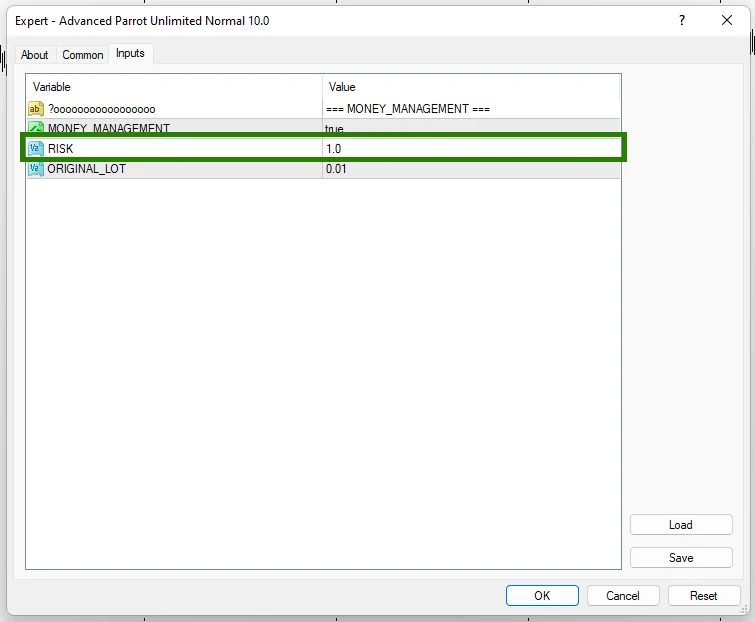

To set a trading risk limit, use the “Risk” variable. Set this variable to a trading risk value. By default, the risk size is set to “1”, which means that for each trade, the Advanced Parrot Scalper will use 1% of your capital.

This is quite an adequate value of trading risk, which will provide you with a good capital gain with minimal risk. We do not recommend setting the risk parameter to more than “5”.