Key Features:

- Portfolio - 10 assets

- Max DD - no more 5%

- Maximum 1 trade at a time

- Only $200 for start (or more)

- Works without martingale

- Each deal is protected by SL

- Prop Firm Passed

Developed for :

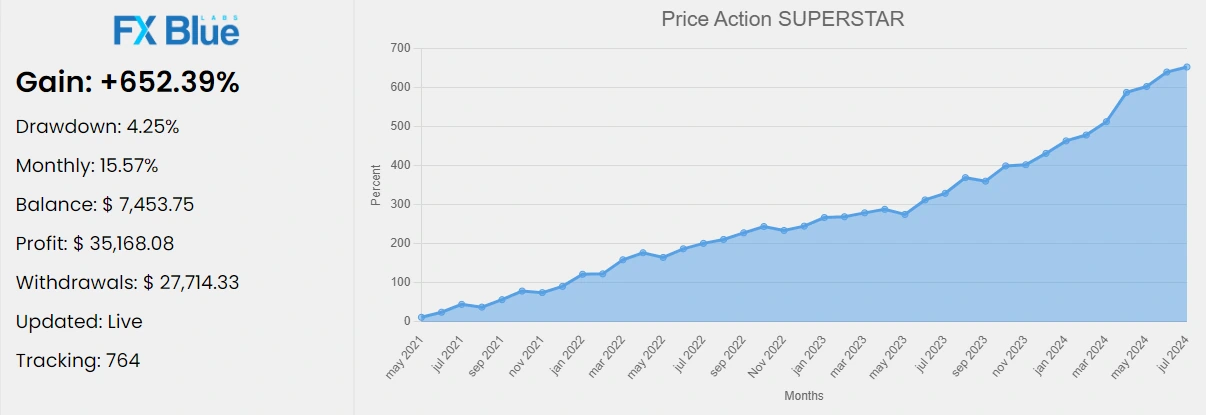

Check how it works online!

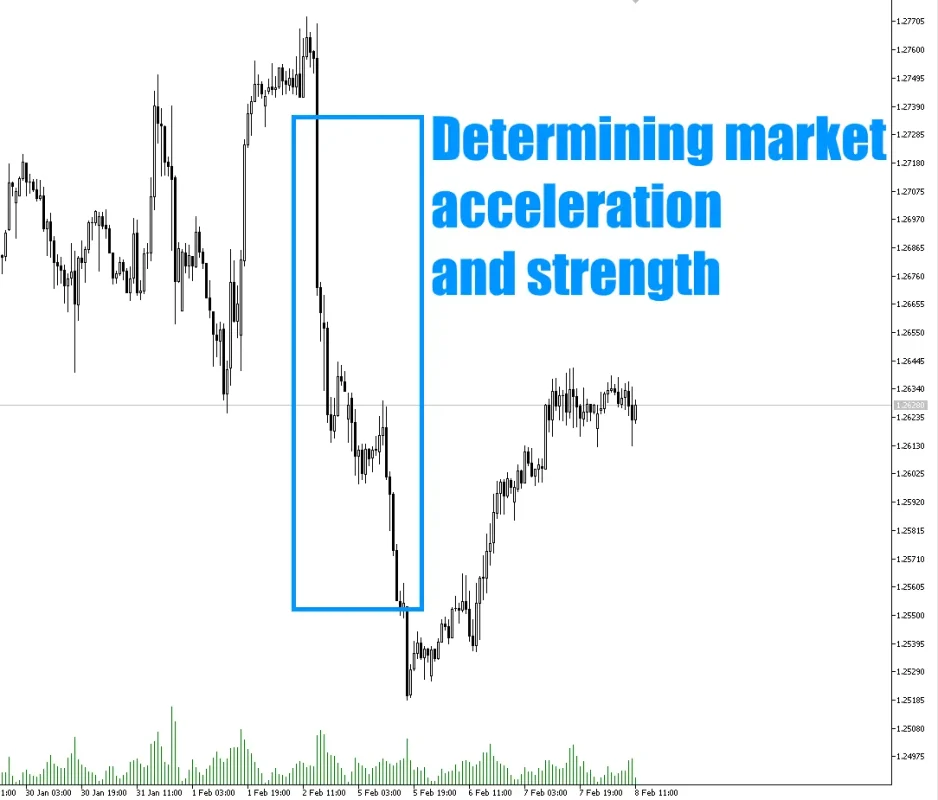

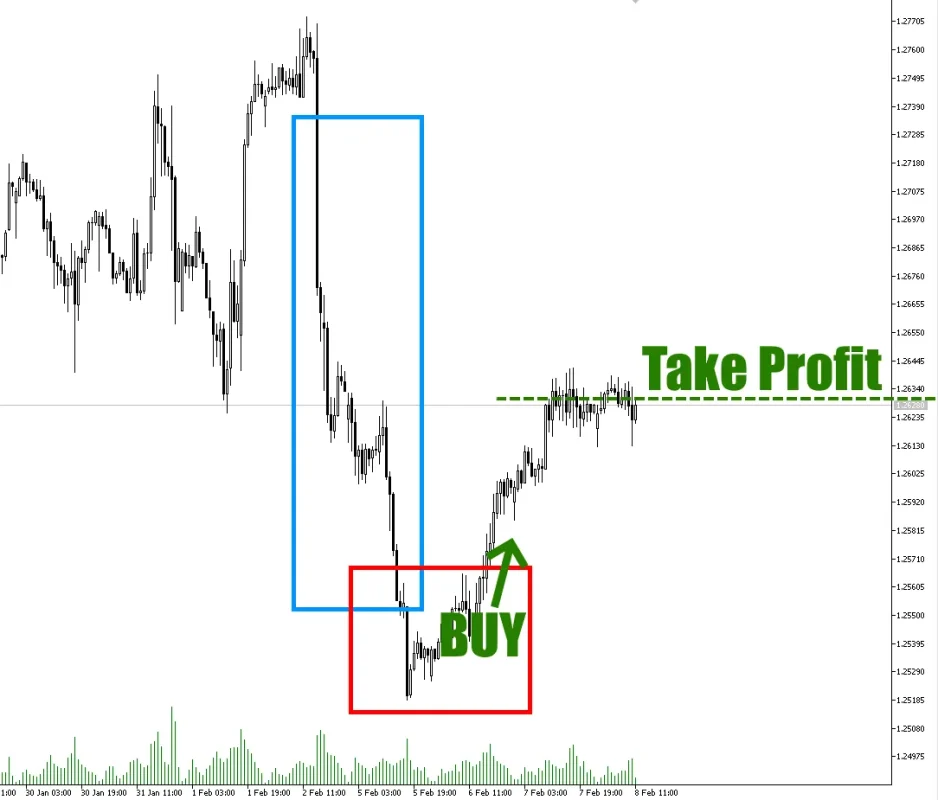

How does this strategy work?

- Determines price acceleration

- Catches the moment of deceleration

- Start works at the beginning of a reversal

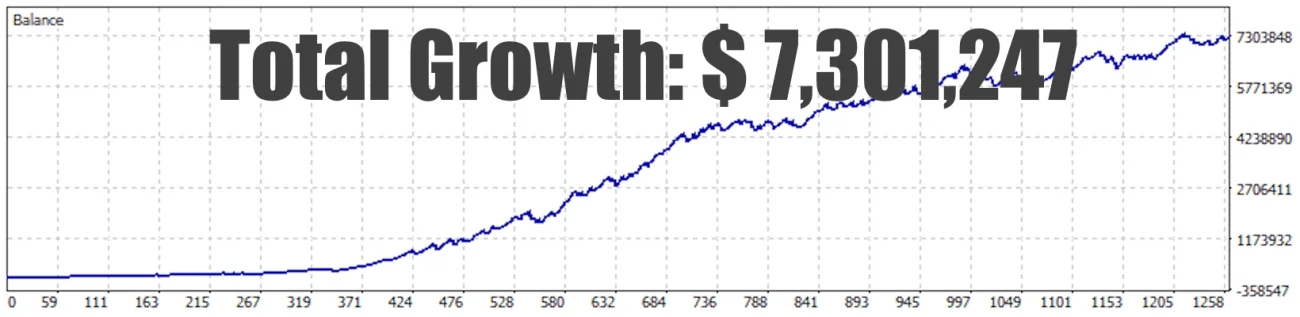

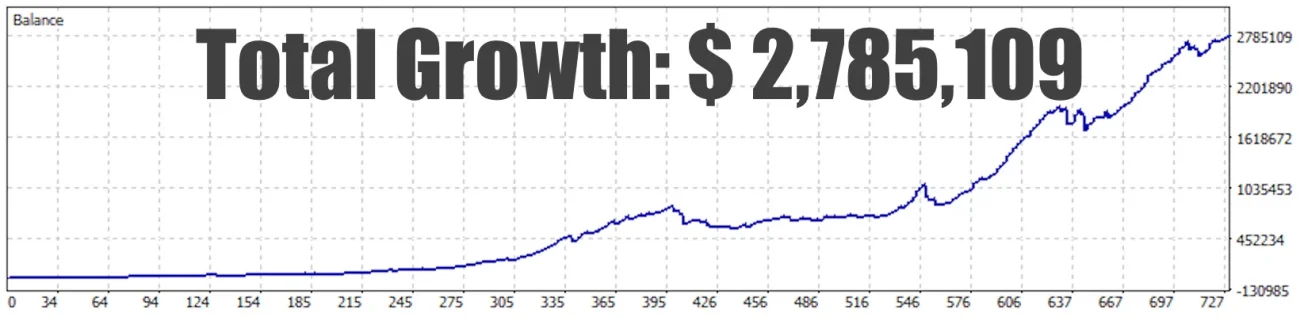

Up to $7 million!!

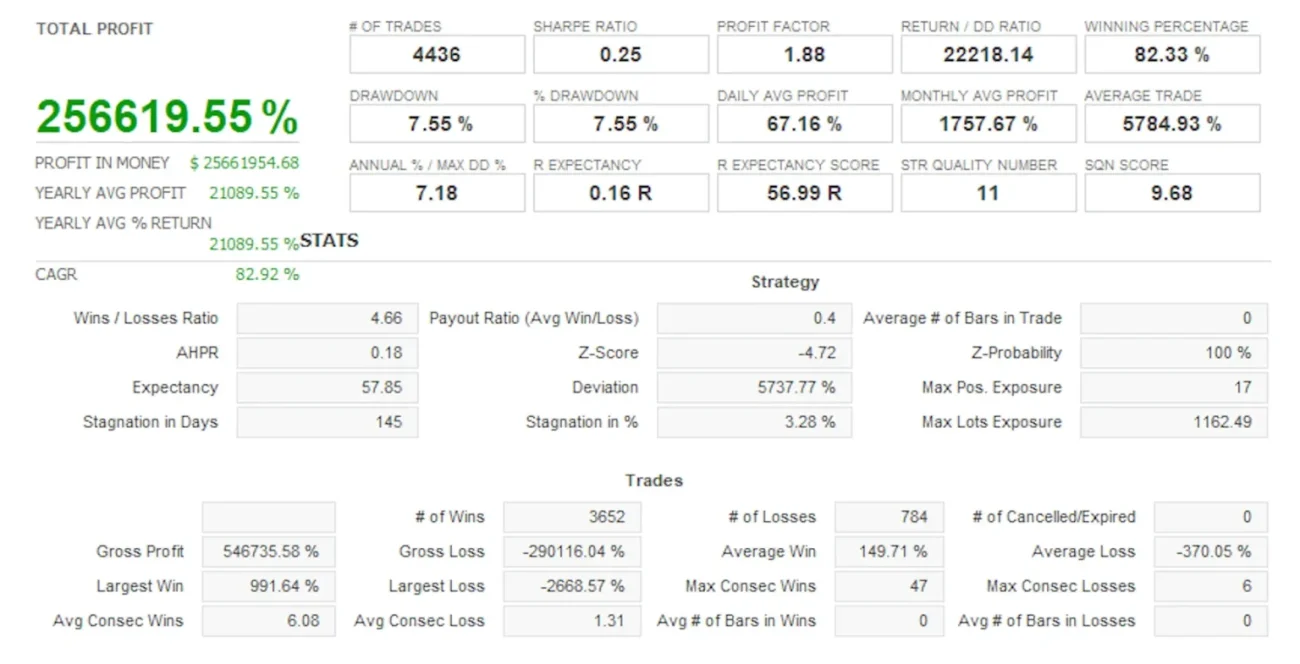

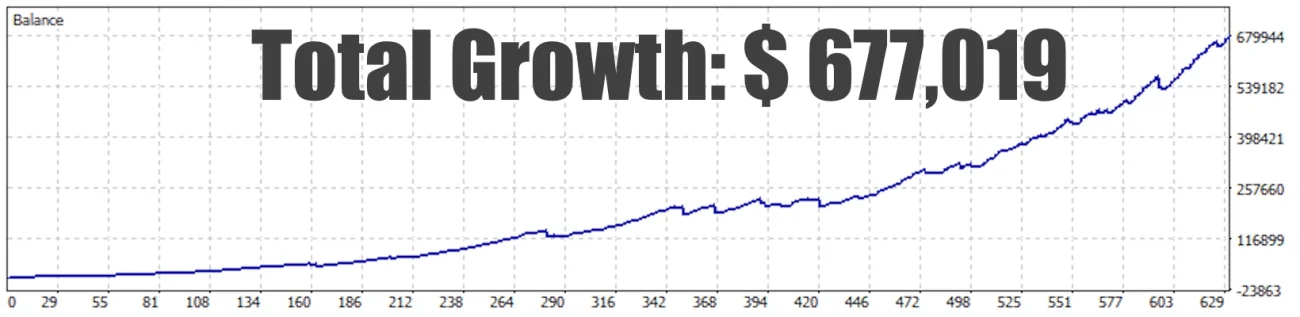

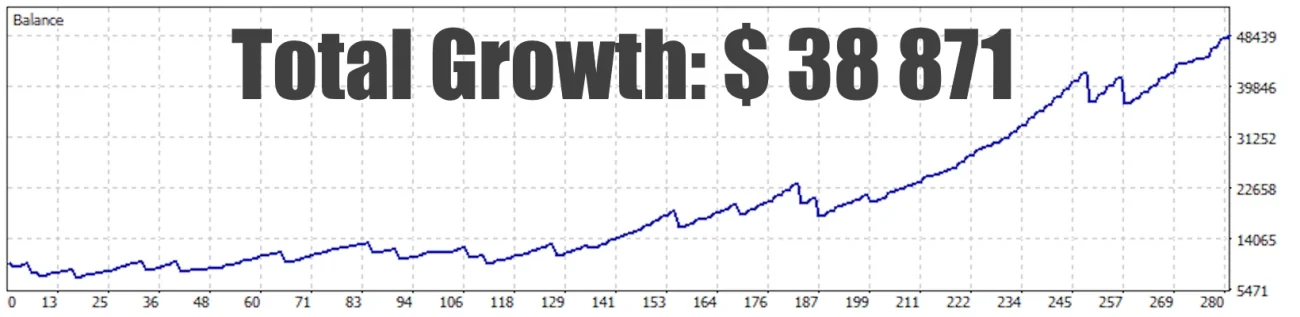

Tester results:

Main portfolio:

Selected Results:

- AUDCAD

- AUDUSD

- EURAUD

- EURGBP

- GBPUSD

- USDJPY

Additional portfolio:

- AUDJPY

- CADCHF

- EURCHF

- GBPCAD

Minimal correlation:

Reviews from real users

This is one of the best automated trading strategies in my arsenal! This trading robot always carefully increases my trading account and I am completely calm about future results. I am absolutely sure that this trading is safe - because every trade is protected by SL and because this software does not use dangerous strategies such as Martingale or averaging.

The maximum DD that appeared on my account for the entire time I used this trading robot was no more than 5%. Now do you understand why purchasing a Superstar trading robot will make you a Prop Firm winner?!?!

If you know even a little about automated trading, that is, if you have at least a little experience, then you will agree with me that security (SL protection and no martingale) is a guarantee that your account will remain intact. At this time, a good trading strategy will make you rich. I'm talking specifically about Superstar bot. This is exactly how this trading robot functions.

I installed this trading robot on my VPS and now I am consistently getting about 15% every month. I took minimal risks and this performance makes me very happy!!!

Do you want to receive about 20-35% growth every month! Buy this trading robot! Superstar bot is exactly what you are looking for!

Get this Software and START TRADING right now!